In the space of about twelve hours, I had an interesting lightbulb moment.

Last night, I was catching up with a former colleague of mine on the phone. When we worked together, he was a high-performing sales rep. Just a few short years later, he gave up his lucrative career to follow his real passion. Today, he’s living in Nashville and managing a band that has cut two records and is beginning to make some real traction.

This morning, I had a call with a friend who I was introduced to about a year ago for potential business collaboration. While that didn’t take off, we did connect on a fundamental gut level. He’s recently just shut the doors to his business, and was sharing an incredible idea he was exploring.

What do these two guys have in common? If you met them, your surface response would be, “Ummm, nothing!” And yet, one more moment happened this morning that tied it all together for me. Our Rapid7 headquarters is moving next month, to a pretty epic new building. In our scramble to finalize the space, we realized we had numerous bookshelves in our new library/speakeasy...but no books to place on them. We approached this dilemma the same way we do with most challenges in our company; we enlisted the help of our people. We asked people to supply us with recommendations of their favorite books that support everything from cybersecurity to leadership to our core values. I spent much of my weekend ordering their picks and will include their recommendation write-ups for people to reference. The books started arriving this week, as did my organization of them into general categories. While I was doing so, I noticed a number of titles that screamed out bold claims in being able to help the reader “live their best life.”

I pulled a few of those volumes to skim and then thought back to my two friends. I realized that there is a multitude of books, apps, retreats and the like claiming to have the answers to how to aid one in actually achieving this. And yet, if you think hard, I’ll challenge you to come up with a list of more than a handful of people in your life who can honestly claim they’ve gone after and truly pursued the life they aspire to lead. And if so many people desire that, why do so few find success in achieving it?

I certainly don’t have the answer. I just know I seem to be drawn to people who live like this, as I relate to them on a core level. I’ve often written about courage and audaciousness. And yet, I often find myself frustrated because I know so many incredibly bright, impressive people who are capable of greatness but somehow get in their own way and never fully realize it. After a bit of time reflecting on the conversations with my friends, balanced with all these books piled on my office floor claiming to help you live like them, I have brainstormed my own list of how to really go after the life and career you want...and hopefully take a step closer to making it a reality.

-

Bring You. “Bring You” is Rapid7’s core value focused on being your authentic self. No matter how many things you share in common with people, every single human being has their own unique blueprint for the way they’d love to map out their lives. Own it, and believe that those differences are not only what makes you special, but have the ability to become your competitive advantage. And remember, only YOU can take control of ensuring your life is playing out the way you want it to. Take a deep breath, and believe in yourself, and that you can accomplish whatever it is you are about to sign up for. If you don’t believe you can pull it off, why should anyone else?

-

Identify your passion. At some point, whether it’s an interview, a date, or just a conversation with a friend, I ask nearly every person “what are you passionate about?” I don’t care what the actual answer is; I just care that there is an answer. While I try hard not to be judgmental in life, I will readily cop to that fact that I judge you if you don’t have an answer. Whether it’s your graphic novel collection, teaching yourself new computer languages, etc. we all seem to find more meaning when we can identify what we truly care about. It provides us with a reason to learn, evolve and work towards mastery. It also aids in connecting you with others who share a similar interest.

-

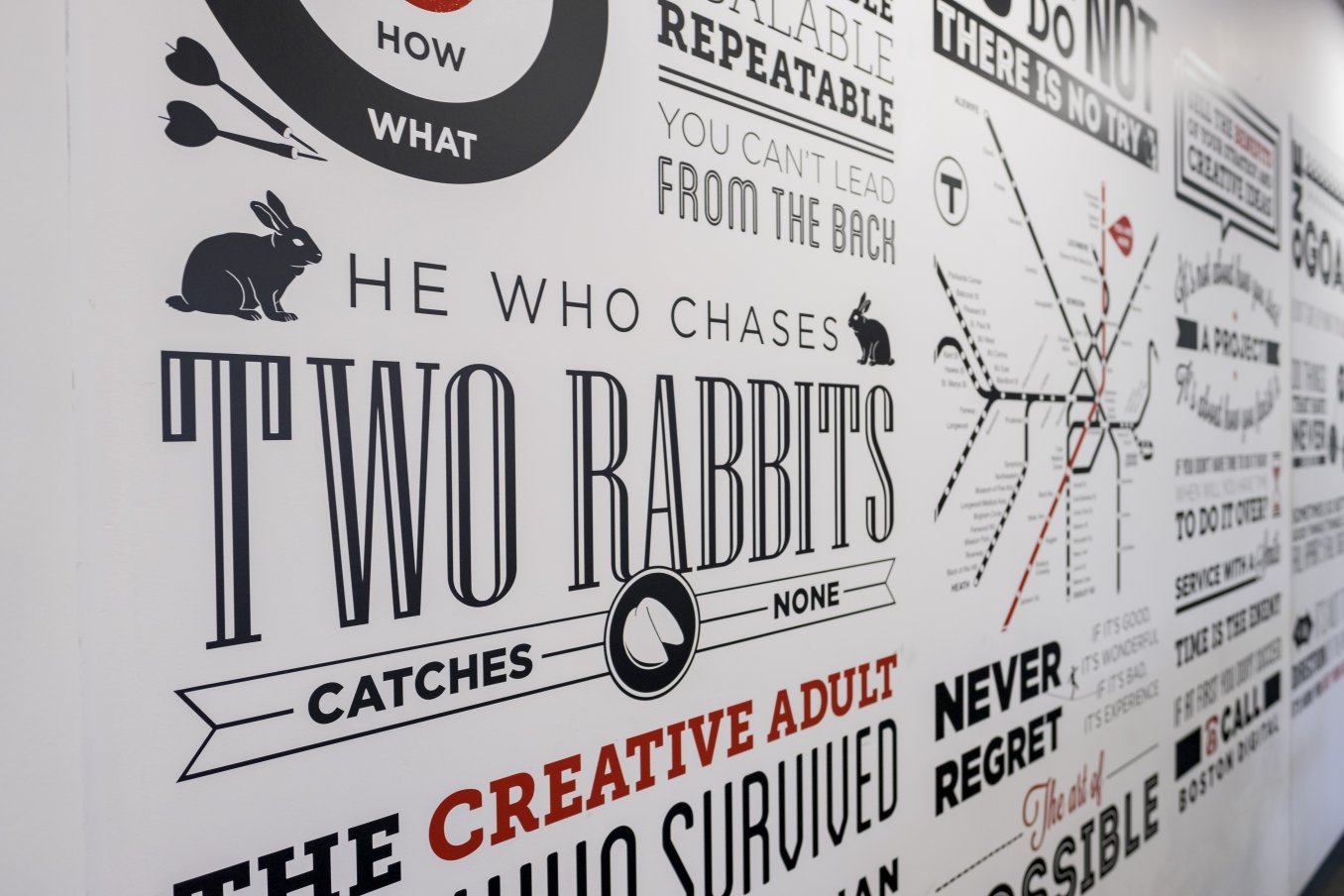

Set a goal...and be a little audacious. Ok, now you know what you are passionate about. Next step is to channel that into your life in a form that you think will really add value. Tie a clear goal to it, and begin to measure your progress often. For example, if you are passionate about writing, but you don’t carve out any time in your life to actually do it, chances are you’ll never complete that novel or short story you’ve always dreamed of publishing. And yet, if you set the audacious goal of “I’m going to write my novel by the end of 2019…” and then break it into chunks like, “I’ll write 1000 words a day, no matter what” and maybe an “I’m signing up for that writing class after work on Tuesdays” you set yourself in a far better position to achieve it.

-

Find some discipline. In the fantastic Malcolm Gladwell book Outliers, he famously shares that the key to success and gaining true mastery takes 10,000 hours. I don’t know about you, but 20 hours a week to gain mastery over a 10 year period of time isn’t my jam. However, the underlying point of finding the discipline to practice, work your butt off and not give up is 100% true. I tend to work from the premise that we are not handed anything in life. If we want to accomplish something astonishing, we must work for it. And work hard. In our instantaneous world of immediate gratification, this one can be a hard pill to swallow. And yet, if you think about all the people you know who are really optimizing their lives, you’ll likely readily admit they are working their tails off to make that be the case.

-

Create opportunities for yourself. Once you have started down this path of accountability with your direction and goal, and you’ve supported it with the discipline to make progress every day, seek out opportunities to build on it. I care deeply about community service and used to commit a large portion of my time to it. Then I became busy with my work and raising kids, and something I cared deeply about fell off my priority list. Guess what? That missing component took a hit on my overall life satisfaction. Once I realized that I created a new opportunity to weave it back into my life. I blurred the passion I had for helping others with my company’s desire to give back to our community. Several years of community service days and a rotation program with a community service element stitched in, and I’ve found a way to blend things in a way that has both benefitted my company and my personal goals in life.

-

Consider your posse. Now think about the people you spend the majority of your time with. Do they support the passion and goals you identified? Do they share common dreams or aspirations? Do you gain energy by spending time with them, or do they zap it? As I realized with my two friends, I am inspired and motivated by people who I recognize as bold, innovative thinkers who just might be slightly crazy in all the best ways. I find that if I spend too much time with people who are close-minded, or too fearful about taking risks, I tend to pull away from them because they pull from my energy. If you are really trying to set yourself up to live your best possible life, who you spend your time with can either bolster those efforts...or have a serious negative effect on your success rate.

There are probably hundreds of more pieces of advice that people who live like this could share. At its core, however, remember this. You’ve got one life. You can choose to embrace it wholeheartedly, and commit to accomplishing the things you believe will enhance it to its full potential. OR you could choose to read a few books, download an app, and start making wishes that your dreams will magically come true. I’m a realist...I’ll be the one making sure I never give up until I accomplish everything on my bucket list.

Hope you’re with me.