As a mentor for Rough Draft Ventures, General Catalyst’s student-focused program that backs founders at the university level, I recently led a discussion with RDV founders on How to Reach Angel Investors and Build Your Company in Boston. While the initial discussion detailed how to get in front of angel investors, the group was eager to learn about what happens next.

What does the process look like from the other side of the table?

How do angel investors evaluate and make investment decisions?

In an effort to debunk the angel investing process, I asked eight prolific angel investors to share details on one angel investment they’ve made in the past year:

- Wayne Chang (@wayne) — investor in SoFi, JetSmarter

- Zen Chu (@accelmed) — investor in PillPack, Figure1

- Ty Danco (@tydanco) — investor in Crashlytics, Postmates

- Steven Kane (@stevenkane) — investor in Gamesville, Conduit Labs

- Rich Miner (@richminer) — investor in HubSpot, DialPad

- Andy Palmer (@andyhpalmer) — investor in PillPack, eShares

- Halle Tecco (@halletecco) — investor in Quora, Misfit Wearables

- Joanne Wilson (@thegothamgal) — investor in Blue Bottle Coffee, Le Tote

1. Let’s dig into one angel investment you’ve made in the past year. How did you meet the founder(s)?

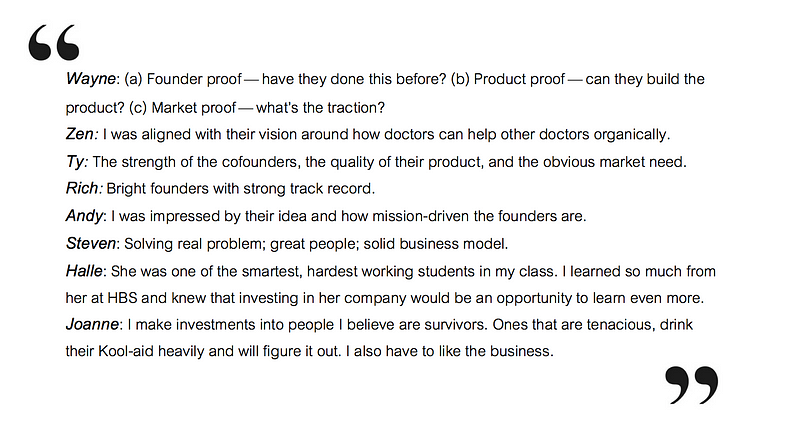

2. What was it that convinced you to invest in the company?

3. Did you meet the founders in person prior to investing in the company?

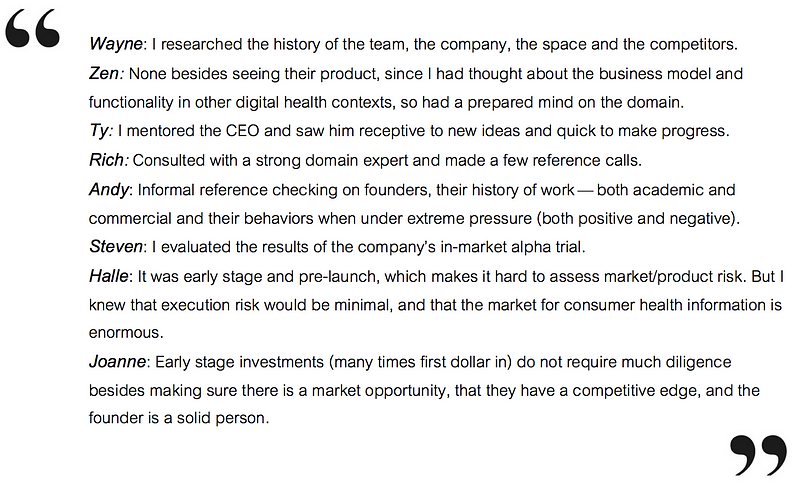

4. Can you describe any due diligence you performed to evaluate the investment opportunity?

5. How do you assess the potential of a first-time entrepreneur?

Thanks to Wayne, Zen, Ty, Rich, Andy, Steven, Halle, and Joanne for allowing us to take a look inside the minds of angels. Thanks also to Natalie Bartlett and Michelle Dipp for their collaboration on this post.

Jennifer Lum is an entrepreneur and investor. Follow her on Twitter: @lum.