We started our quarterly funding analysis across the Boston tech landscape last quarter. This includes companies that are in the tech (as in software, AI, etc.) and climate tech industry. It does not include biotech & pharma companies unless there is a major component that is driven based on our definition of tech.

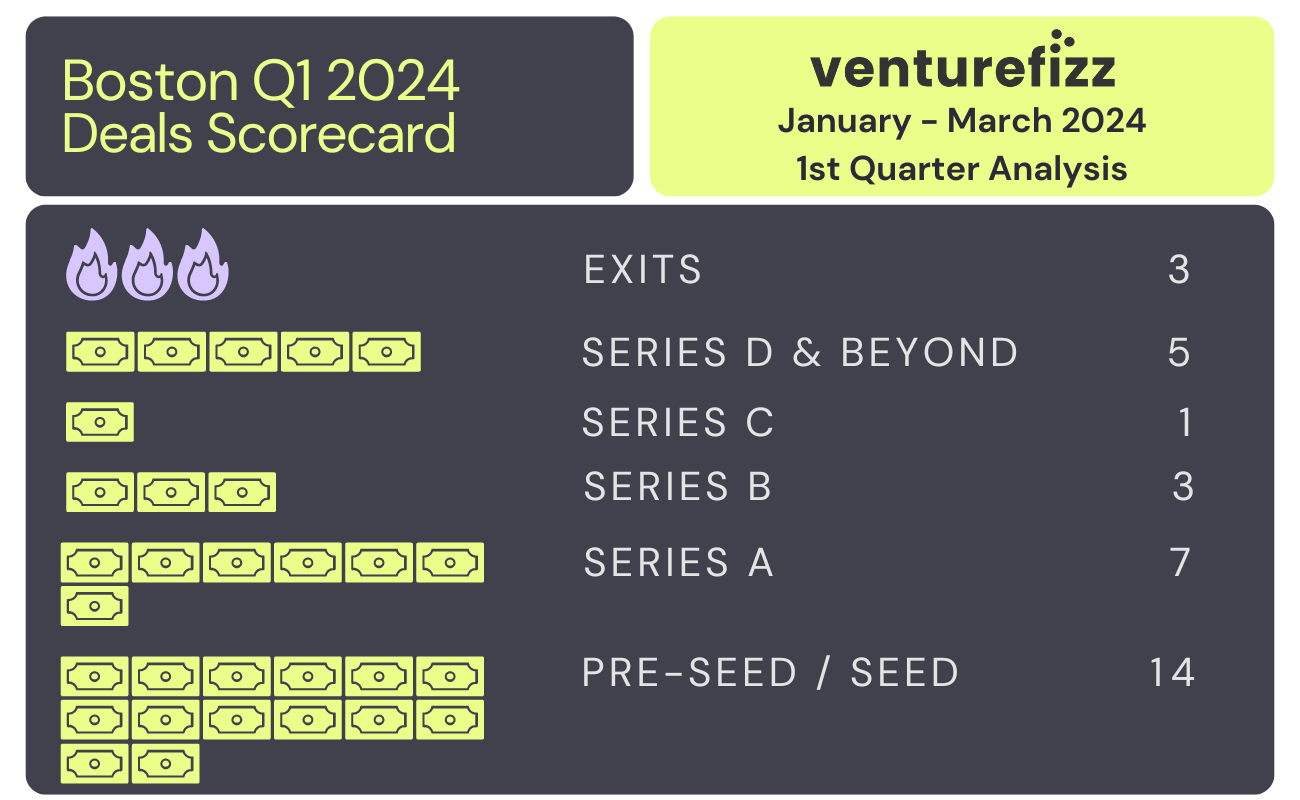

Here is a link to the analysis for Q1. To recap, $864.6M was raised in Q1 of 2024 across the following stages:

For Q2, the aggregate amount of funding across all rounds and companies was approximately (a couple of the rounds of funding were undisclosed):

~ $1.45B

This is a significant step forward and positive momentum, but in my opinion, what's the most exciting element to Q2's funding data is the quality of companies that were funded in the early stages. It feels like there is a new wave of anchor companies that are being formed in the early stage that are founded by repeat entrepreneurs or individuals who are uniquely qualified to build a big company. Five examples include:

- Seven AI - founded by Lior Div and Yonatan Striem-Amit... the founders Cybereason.

- EnFi - founded by Josh Summers (clypd - acquired by Xandr) and Scott Weller (SessionM - acquired by Mastercard)

- Maven AGI - founded by Jonathan Corbin (HubSpot), Eugene Mann (Stripe / Google), Sami Shalabi (4x Startups - one acquired by Google)

- Day.ai -founded by Chris O'Donnell (HubSpot, ProfitWell) and Michael Pici (HubSpot)

- Suno - founded by Mikey Shulman (Kensho), Georg Kucsko (Kensho), Martin Camacho (Firefly Health & Kensho), and Keenan Freyberg (Kensho)

Some more observations from the data:

- 4 investors announced new funds:

- Wellington Management - $385M for tech-enabled solutions to mitigate and adapt to climate change

- SpringTide - $65M Fund II

- Floating Point - $70M second fund

- The Engine - ~$400M Fund III for hard tech (Listen: The VentureFizz Podcast with Reed Sturtevant, General Partner)

- There is a lack of exit opportunities for companies as witnessed by this quarter's data.

- Mega-rounds from Vecna Robotics, Alsym Energy, Creatio, Buyers Edge Platform, and Binx Health.

If you are interested in getting the Deals information weekly, you can sign up for our popular Weekly Email Digest which has all the must know information from the Boston tech scene! It's your one email a week to stay plugged in! Sign up here:

Exits

Zapata AI (industrial generative AI software company) started trading as a public company via SPAC on the NYSE.

Funding

Series D and Beyond

Binx Health (diagnostic testing startup) raised $65M Series F

Investors: Hildred Capital led, and was joined by EQT Life Sciences

Buyers Edge Platform (provider of digital procurement solutions for foodservice) raised $425M in equity funding

Investor: General Atlantic Credit

Creatio (no-code platform to automate CRM and enterprise workflows) raised $200M at $1.2B valuation

Investors: Led by Sapphire Ventures, with participation from StepStone Group and current investors, Volition Capital and Horizon Capital.

Series C

![]()

Alsym Energy (battery startup) raised $78M Series C funding

Investors: General Catalyst and Tata co-led, and were joined by Drads Capital, Thomvest, and Thrive Capital

Vecna Robotics (warehouse automation & robotics) raised $100M Series C Funding

Investors: Tiger Global Management, Proficio Capital Partners, and IMPULSE

![]()

Numerated (digital loan origination system) raised undisclosed amount of strategic investment

Investor: Citi

Series B

Suno (generative AI for music creation) raised $125M in funding

Investors: Lightspeed Venture Partners, Nat Friedman and Daniel Gross, Matrix and Founder Collective

AcuityMD (commercial intelligence platform for MedTech manufacturers) Raised $45M Series B funding

Investors: ICONIQ Growth, with additional participation from Boston-based Atreides Management and New York-based Stepstone Group as well as existing investors Redpoint Ventures, Benchmark Capital, and Artisanal Ventures

Sware (FDA-mandated software validation automation) raised $6M Series B funding

Investors:

Aidentified (AI-powered prospecting and relationship intelligence platform for financial services professionals) raised $12.5M Series B funding

Investor: FactSet

Posh AI (generative & conversational AI for banks & credit unions) raised funding

Investors: Curql, Canapi Ventures and TruStage Ventures

Form Health (science-based obesity care) raised $38M Series B

Investors: Sound Ventures, with participation from M13, SignalFire, and Next View Ventures

Series A

Allure Security (brand protection software) raised $10M Series A

Investor: Curql

Manifold (AI-powered clinical research platform) raised $15M in Series A funding

Investors: TQ Ventures led, and was joined by Calibrate Ventures, SK Ventures, and TTCER Partners

Inkbit (advanced additive manufacturing solutions) raised $19M financing round

Investors: Led by Ingersoll Rand (NYSE: IR), with participation from Future Labs Capital, GC Ventures America, iGlobe Partners, Ocado, Phoenix Venture Partners, Stratasys, Zeon Ventures, and other private investors.

Neurable (brain computer interface) raised $13M

Investors: Ultratech Capital Partners, TRAC, Pace Ventures, and Metaplanet

Rapid Liquid Print (additive manufacturing) raised $7M in Series A funding

Investors: HZG Group with participation from existing investors BMW i Ventures and MassMutual.

![]()

Monitaur (model governance platform for highly-regulated industries) raised $6M Series A

Investors: Cultivation Capital, with participation from Rockmont Partners and others including Defy VC, Techstars, and Studio VC

![]()

Nabla Bio (AI and wet-lab technologies) raised $26M Series A Funding

Investors: Radical Ventures with participation from all existing investors, and strategic collaborations with AstraZeneca, Bristol Myers Squibb Company and Takeda

Maven AGI (AI agents for customer support) raised $28M

Investors: Lux Capital, M13, E14 Fund, Mentors Fund and 786 Ventures, with participation from executives from OpenAI, Google, HubSpot, and Stripe

Axena Health (medical devices for women's pelvic health) raised $9.4M Series A

Investors: Cross-Border Impact Ventures (CBIV) alongside existing investors AXA IM Alts through its Global Healthcare Private Equity Strategy, KOFA Healthcare and Avestria Ventures

HyperSpectral (AI-powered spectral intelligence) raised $8.5M Series A

Investors: co-led by RRE Ventures and Kibo Ventures with participation from Correlation Ventures, and GC&H Investment

Dive (cloud-native & particle-based simulation software) raises $10M Series A funding

Investors: D. E. Shaw Group. Additional investors include First Momentum Ventures, Segenia Capital, and Senovo Capital

Marigold Health (tech-enabled peer recovery) raised $11M Series A funding

Investors: led by Rock Health and Innospark Ventures with additional investment from the Commonwealth Care Alliance (CCA), Wavemaker360, Stand Together Ventures Lab, Epsilon Health Investors, Koa Labs, VNS Health Plan and KdT Ventures

Entro Security (non-human identity (NHI) security) raised $18M Series A

Investors: led by Dell Technologies Capital with the participation of seed investors Hyperwise Ventures and StageOne, as well as angel investors such as Rakesh Loonkar and Mickey Boodae

Heyday Health (telehealth for older adults) raised $12.5M in funding

Investors: Gradient Ventures, Google's early stage fund, Lionbird, Great Oaks Capital and Kate Ryder, the CEO of Maven

Seed / Pre-Seed

Found Energy (aluminum-thermal power system) raised $12M in seed funding

Investors: KOMPAS VC, Munich Re Ventures, Good Growth Capital, the Autodesk Foundation, J-Impact, GiTV, and others.

Breaking (plastic degradation and synthetic biology company) raised $10.5M in seed funding

Investors: Builders VC, Animal Capital, Climate Capital, and others

VulnCheck (exploit intelligence) raised $8M in seed funding

Investors: Sorenson Capital and others

Pascal (high-efficiency climate-friendly HVAC solutions) raised $8M seed

Investors: Engine Ventures, with Khosla Ventures and previous investor Blindspot Ventures

Active Surfaces (solar tech) raised $5.6M in pre-seed funding

Investors: led by Safar Partners, a prominent deep tech venture capital fund. Additional participants—including QVT, Lendlease, Type One Ventures, Umami Capital, Sabanci Climate Ventures, New Climate Ventures, SeaX Ventures, and others

OncoveryCare (comprehensive, whole-person care to cancer survivors) raised $4.5M seed round

Investors: led by .406 Ventures alongside the McKay Institute for Oncology Transformation at Tennessee Oncology

SiTraction (materials recovery company serving the mining and metals industries) raised $11.8M in seed funding

Investors: led by 2150 with participation from BHP Ventures, Extantia, and Orion Industrial Ventures. Previous investors Azolla Ventures and E14 Fund

Eyebot (AI-powered eye exam kiosks) raised $6M in seed funding

Investors: led by AlleyCorp and Ubiquity Ventures with participation from Humba Ventures, Ravelin, and Spacecadet

Seven AI (AI cybersecurity) raised $36M in seed funding

Investors: Greylock Partners and joined by CRV and Spark Capital

EnFi (AI assistant for credit analysis & risk monitoring) raised $7.5M in funding

Investors: Unusual Ventures, Boston Seed Capital, Argon Ventures and Impellent Ventures

Day.ai (Next Generation AI CRM) raised $4M seed

Investors: led by Sequoia Capital with participation from Pillar VC, Conviction, Stage 2 Capital, Inspired Capital, 20Sales and a number of angels

Synthpop (AI-driven platform for healthcare workflows) raised $5.6M in funding

Investors: led by Peterson Ventures, with significant participation from defy.vc, Zelda Ventures, Think+ Ventures, and OVO Fund