This blog post looks at the high level goals of a SaaS business and drills down layer by layer to expose the key metrics that will help drive success. Metrics for metric’s sake are not very useful. Instead the goal is to provide a detailed look at what management must focus on to drive a successful SaaS business. For each metric, we will also look at what is actionable.

Before going any further, I would like to thank the management team at HubSpot, and Gail Goodman of Constant Contact, who sits on the HubSpot board. A huge part of the material that I write about below comes my experiences working with them. In particular HubSpot’s management team is comprised of a group of very bright individuals that are all very metrics driven, and they have been clear thought leaders in developing the appropriate tools to drive their business. I’d also like to thank John Clancy, who until recently was President of Iron Mountain Digital, a $230m SaaS business, and Alastair Mitchell, CEO and founder of Huddle.

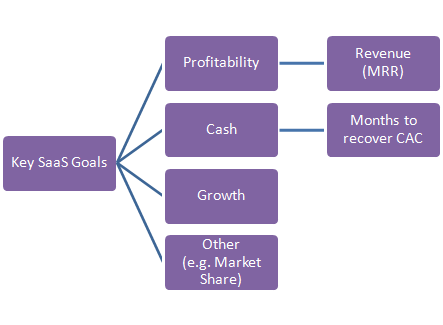

Let’s start by looking at the high level goals, and then drill down from there:

Key SaaS Goals

- Profitability: needs no further explanation.

- MRR Monthly Recurring Revenue: In a SaaS business, one of the most important numbers to watch is MRR. It is likely a key contributor to Profitability.

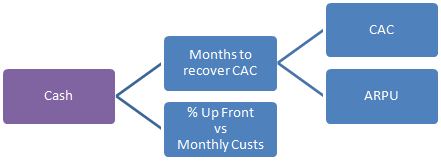

- Cash: very critical to watch in a SaaS business,

as there can be a high upfront cash outlay to acquire a customer, while

the cash payments from the customer come in small increments over a

long period of time. This problem can be somewhat alleviated by using

longer term contracts with advance payments.

- Months to recover CAC: one of the best ways to

look at the capital efficiency of your SaaS business is to look at how

many months of revenue from a customer are required to recover your

cost of acquiring that customer(CAC). In businesses such as banking and

wireless carriers, where capital is cheap and abundant, they can afford

a long payback period before they recover their investment to acquire a

customer (typically greater than one year). In the startup world where

capital is scarce and expensive, you will need to do better. My own

rule says that startups need to recover their cost of customer

acquisition in less than 12 months.

(Note: there are other web sites and blogs that talk about the CAC ratio, with a complex formula to calculate it. This is effectively a more complicated way of saying the same thing. However I have found that most people cannot relate well to the notion of a CAC ratio, but they can easily relate to the idea of how many months of revenue it will take to recover their investment to acquire a customer. Hence my preference for the term Months to Recover CAC.)

- Months to recover CAC: one of the best ways to

look at the capital efficiency of your SaaS business is to look at how

many months of revenue from a customer are required to recover your

cost of acquiring that customer(CAC). In businesses such as banking and

wireless carriers, where capital is cheap and abundant, they can afford

a long payback period before they recover their investment to acquire a

customer (typically greater than one year). In the startup world where

capital is scarce and expensive, you will need to do better. My own

rule says that startups need to recover their cost of customer

acquisition in less than 12 months.

- Growth: usually a critical success factor to gaining market leadership. There is clear evidence that once one company starts to emerge as a market leader, there is a cycle of positive reinforcement, as customers prefer to buy from the market leader, and the market leader gets the most discussion in the press, blogosphere, and social media.

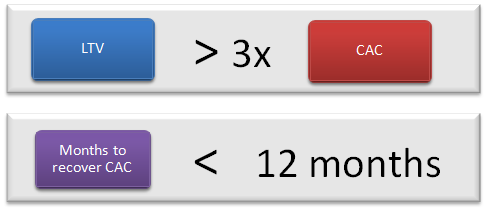

Two Key Guidelines for SaaS startups

The above guidelines are not hard and fast rules. They are what I have observed to be needed by looking at a wide variety of SaaS startups. As a business moves past the startup stage, these guidelines may be relaxed.

In the next sections, we will drill down on the high level SaaS Goals to get to the components that drive each of these.

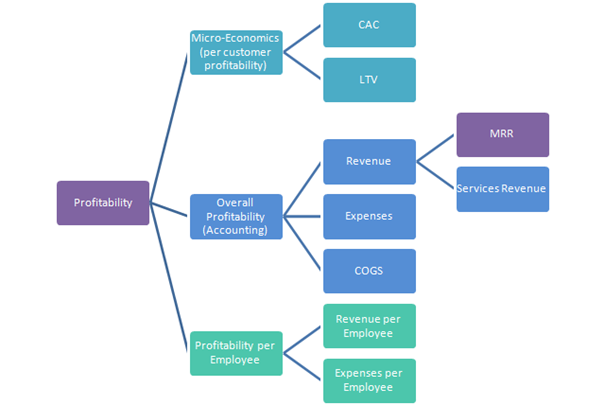

Three ways to look at Profitability

- Micro-Economics (per customer profitability): Micro-economics is the term used to describe looking at the economics of your business on a single customer level. Most business models (with a few exceptions such as marketplaces) are based around a simple principle: acquire customers and then monetize them. Micro-economics is about measuring the numbers behind these two essential ingredients of a customer interaction. The goal is to make sure the fundamental underpinnings of your business are sound: how much it cost to acquire your customers, and how much you can monetize them. i.e. CAC and LTV (cost of acquiring a customer, and lifetime value of the customer). In a SaaS business, you have a great business if LTV is significantly greater than CAC. My rule of thumb is that LTV must be at least 3x greater than CAC. (As mentioned elsewhere in this blog, your startup will die if your long term number for CAC is higher than your LTV. See Startup Killer: The cost of acquiring customers.)

- Overall profitability (standard accounting method): This looks a the standard accounting way of deriving profitability: revenue – COGS – Expenses. The diagram also notes that Revenue is made up of MRR + Services Revenue. Since MRR is such a critical element, there will be a deeper drill down to understand the key component drivers.

- Profitability per Employee: it can be useful to look at the factors contributing to profitability on a per employee basis, and benchmark your company against the rest of the industry. Expenses per Employee is usually around $180-200k annually for businesses with all their employees in the US. (To calculate the number take the total of all expenses, not just salaraies, and divide by the number of employees.) Clearly to be profitable in the long term, you will want to see revenue per employee climb to be higher than expenses, taking into account your gross margin %.

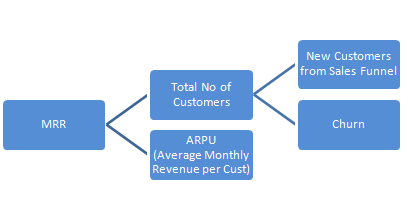

Drill down on MRR

MRR is computed by multiplying the total number of paying customers by the average amount that they pay you each month (ARPU).

- Total Customers: a key metric for any SaaS company. This increases with new additions coming out the bottom of the sales funnel, and decreases by the number of customers that churn. Both of these are key metrics, and we will drill down into them later.

- ARPU – average monthly revenue per customer: (The term ARPU comes from the wireless carriers where U stands for user.) This is another extremely imporant variable that can be tweaked in the SaaS model. If you read my blog post on the JBoss story, you will see that one of the key ways that we grew that business was to take the average annual deal size from $10k, to $50k. Given that the other parts of the pipeline worked with the same numbers and conversion rates, this grew the business by 5x. We will drill down into how you can do the same thing a little further on.

Drill down on Micro-Economics (Per Customer Profitability)

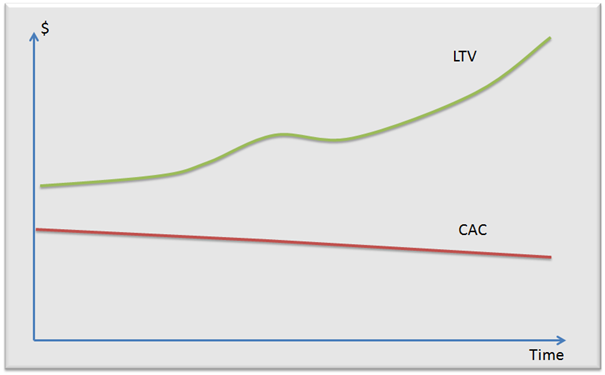

Our goal is to see a graph that looks like the following:

To achieve this, lets look at the component parts of each line, to see what variables we can use to drive the curves:

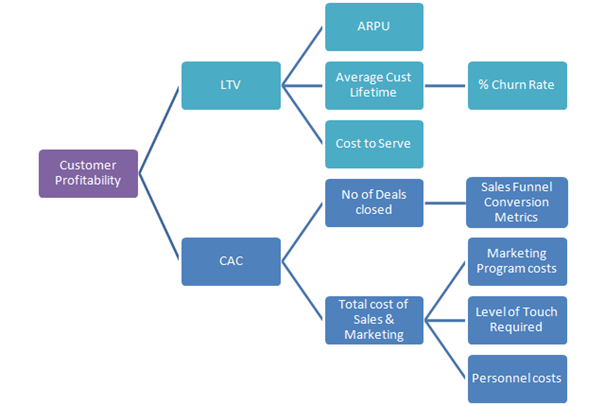

As mentioned earlier, customer profitability = LTV – CAC.

Drill down on LTV

Drilling down into the factors affecting LTV, we see the following:

LTV = ARPU x Average Lifetime of a Customer – the Cost to Serve them (COGS)

It turns out that the Average Lifetime of a Customer is computed by 1/Churn Rate. As an example, if a you have a 50% churn rate, your average customer lifetime will be 1 divided by 50%, or 2 months. In most companies that I work with, they ignore tracking the average lifetime, but instead track the monthly churn rate religiously.

The importance of a low churn rate cannot be overstated. If your churn rate is high, then it is a clear indication of a problem with customer satisfaction. We will drill down later into how you can measure the factors contributing to Churn Rate, and talk about how you can improve them.

Drill down on CAC

The formula to compute CAC is:

CAC = Total cost of Sales & Marketing / No of Deals closed

It turns out that we are actually interested in two CAC numbers. One that looks purely at marketing program costs, and one that also takes into consideration the people and other expenses associated with running the sales and marketing organization. The first of these gives us an idea of how well we could do if we have a low touch, or touchless sales model, where the human costs won’t rise dramatically over time as we grow the lead flow. The second number is more important for sales models that require more human touch to close the deal. In those situations the human costs will contribute greatly to CAC, and need to be taken into consideration to understand the true micro-economics.

I am often asked when it is possible to start measuring this and get a realistic number. Clearly there is no point in measuring this in the very early days of a startup, when you are still trying to refine product/market fit. However as you get to the point of having a repeatable sales model, this number becomes important, as that is the time when you will usually want to hit the accelerator pedal. It would be wrong to hit the accelerator pedal on a business that has unprofitable micro-economics. (When you are computing the costs for a very young company, it would be fair to remove the costs for people like the VP of Sales and VP of Marketing, as you will not hire more of these as you scale the company.)

When we look at how to lower CAC, there are a number of important variables that can be tweaked:

- Sales Funnel Conversion rates: a funnel that takes the same number of leads and converts them at twice the rate, will not only result in 2x more closed customers, but will also lower CAC by half. This is a very important place to focus energy, and a large part of this web site is dedicated to talking about how to do that. We will drill down into the Sales Funnel conversion rates next.

- Marketing Program Costs: driving leads into the top of your sales funnel will usually involve a number of marketing programs. These could vary from pay per click advertising, to email campaigns, radio ads, tradeshows, etc. We will drill down into how to measure and control these costs later.

- Level of Touch Required: a key factor that affects CAC is the amount of human sales touch required to convert a lead into a sale. Businesses that have a touchless conversion have spectacular economics: you can scale the number of leads being poured into the top of the funnel, and not worry about growing a sales organization, and the associated costs. Sadly most SaaS companies that I work with don’t have a touchless conversion. However it is a valuable goal to consider. What can you do to simplify both your product and your sales process to lower the amount of touch involved? This topic is covered at the bottom of a prior blog post: Startup Killer: the cost of acquiring customers.

- Personnel costs: this is directly related to the level of touch required. To see if you are improving both of these, you may find it useful to measure your Personnel costs as a % of CAC over time.

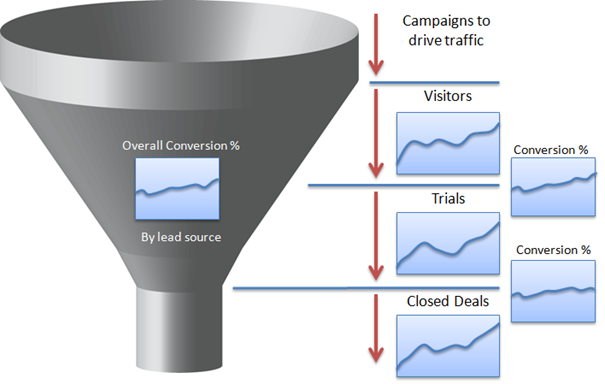

Drill down on Sales Funnel Conversion Rates

The metrics that matter for each sales funnel, vary from one company to the next depending on the steps involved in the funnel. However there is a common way to measure each step, and the overall funnel, regardless of your sales process. That involves measuring two things for each step: the number of leads that went into the top of that step, and the conversion rate to the next step in the funnel (see below).

You will also want to measure the overall funnel effectiveness by measuring the number of leads that go into the top of the funnel, and the conversion rate for the entire funnel process to signed customers.

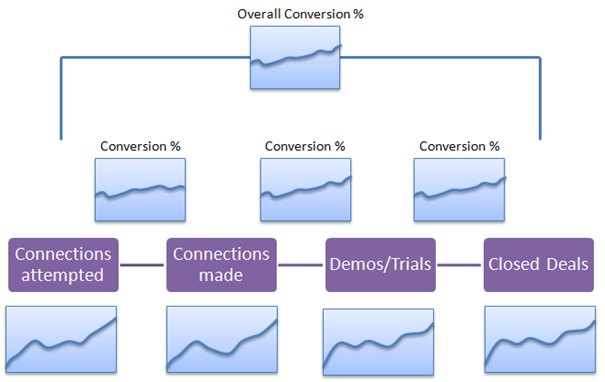

The funnel diagram above shows a very simple process for a SaaS company with a touchless conversion. If you have a conversion process involving a sales organization, you will want to add those steps to the funnel process to get insights into the performance of your sales organization. For example, your inside sales process might look like the following:

Here if we look at the closed deals and overall conversion rates by sales rep, we will have a good idea of who our best reps are. For lower performing reps, it is useful to look at the intermediate conversion rates, as someone that is doing a poor job of, say, converting demos to closed deals could be an indication that they need demo training from people that have high conversion rates for demos. (Or, as Mark Roberge, VP of Sales at HubSpot, pointed out, it could also mean that they did a poor job of qualifying people that they put into the Demo stage.)

These metrics give you the insight you need into your sales and marketing machine, and those insights give you a roadmap for what actions you need to take to improve conversion rates.

Using Funnel Metrics in forward planning

Another key value of having these conversion rates is the ability to understand the implications of future forecasts. For example, lets say your company wants to do $4m in the next quarter. You can work backwards to figure out how many demos/trials that means, and given the sales productivity numbers – how many salespeople are required, and going back a stage earlier, how many leads are going to be required. These are crucial planning numbers that can change staffing levels, marketing program spend levels, etc.

Drill down by Customer Type

If you have different customer types, you will want to look at all the CAC and LTV metrics for each different customer type, to understand the profitability by customer type. Often times this can lead you to a decision to focus more energy on the most profitable customer type.

Drill down into ROI per Marketing Program

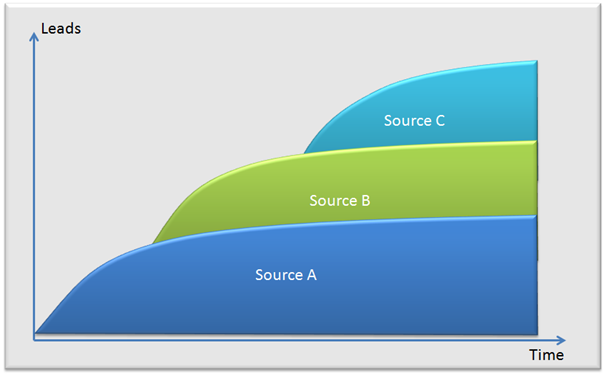

My experiences with SaaS startups indicate that they usually start with a couple of lead generation programs such as Pay Per Click Google Ad-words, radio ads, etc. What I have found is that each of these lead sources tends to saturate over time, and produce less leads for more dollars invested. As a result, SaaS companies will need to be constantly evaluating new lead sources that they can layer in on top of the old to keep growing.

Since the conversion rates and costs per lead vary quite considerably, it is important to also measure the overall ROI by lead source:

Growing leads fast enough to feed the front end of the funnel is one of the perennial challenges for any SaaS company, and is likely to be one of the greatest limiting factors to growth. If you are facing that situation, the most powerful advice I can give you is to start investing in Inbound Marketing techniques (see Get Found using Inbound Marketing). This will take time to ramp up, but if you can do it well, will lead to far lower lead costs, and greater scaling than other paid techniques. Additionally the typical SaaS buyer is clearly web-savvy, and therefore very likely to embrace inbound marketing content and touchless selling techniques.

From Alistair Mitchell, CEO of Huddle: “Just calculating CAC can be extremely complicated, given the numerous ways in which people find out about your service. To stop getting too bogged down in the detail, its best to start with a blended rate that just takes your total spend on marketing (people, pr, acquisition etc) and split this across all your customers, regardless of type or source. Then, once you’ve got comfortable with that, you can start to break CAC down by the different customer types and elements of your inbound funnel, and start measuring specific campaigns for their contribution to each customer type.”

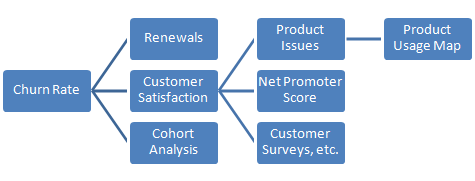

Drill down into Churn Rate

As described in the section on LTV, Churn Rate has a direct effect on LTV. If you can halve your churn rate, it will double your LTV. It is an enormously important variable in a SaaS business. Churn can usually be attributed to low customer satisfaction. We can measure customer satisfaction using customer surveys, and in particular, the Net Promoter Score.

If you are using longer term contracts, another key metric to focus on is renewals. From John Clancy, ex-President of Iron Mountain Digital: “

Non-renewals add to churn, but they can have different drivers. We spent a lot of time examining our renewal rates and found that a single digit improvement made a huge difference. Often times the driver on a non-renewal is economic – the internal IT department has mounted a campaign to bring the solution back in house. SaaS businesses need to identify renewal dates and treat the renewal as a sales cycle (it’s much easier and less expensive than a new sale, but it deserves the same level of attention) Many SaaS businesses make the mistake of taking renewals for granted.”

A good predictor of when a customer is about to churn is their product usage pattern. Low levels of usage indicate a lack of commitment to the product. It can be a good idea to instrument the product to measure this, looking for particular features our usage patterns that are correlated with stickiness, or a likelihood to churn.

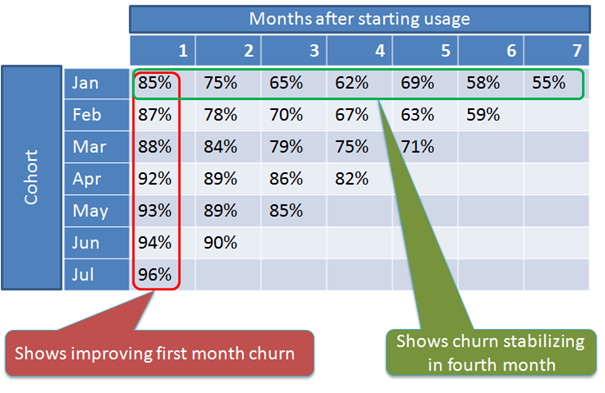

Another measurement tool that can be very useful in understanding churn is to look at a Cohort Analysis. The term cohort refers to a group of customers that started in the same month. The reason for doing this is that churn varies over time, and using a single churn number for all customers will mask this. Cohort analysis shows:

- How churn varies over time (the green call out below).

- How churn rates are changing with newer cohorts, (the red call out below) For example in the early days of your SaaS company, you may have serious product problems and lose a lot of customers in the first month. Over time your product gets better, and the first month churn rate will drop.

Cohort analysis will show this, instead of mixing all the churn rates into single number.

Here’s a comment on Cohort Analysis from Alastair Mitchell, CEO of Huddle: “I actually think this is more important than churn, for the simple fact that churn varies over the lifetime of a customer cohort, and just looking at monthly churn can be very misleading. Also, given the importance of payback in a year – you really want to look at churn over the course of a 12 months cohort. For instance, in the first 3 months of a monthly paying customer you will see high churn (3 is a recurring ‘magic’ number in all of retail), then reduced churn (sometimes even positive churn) over the next 3 months less and then probably more stable spend over the next 6 months. The number you really care about is the % of customers spending after 12 months (not necessarily on a monthly basis) as that’s what matters for your CAC payback calculations.”

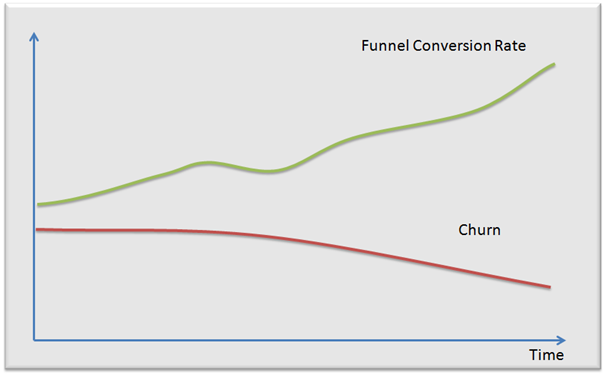

Two variables that really matter

As we saw above, there are two variables that have a huge effect on a SaaS business: funnel conversion rate, and churn, and it is not a bad idea to graph them as shown below.

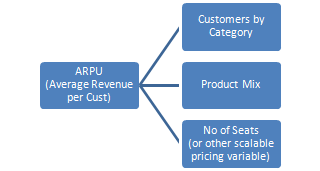

Drill down into ARPU (Average Revenue per Customer)

ARPU is often different for different customer categories, and should be measured separately for each category. It can usually be driven up by focusing on:

- Product Mix: adding products to the range, and using bundles, and cross-sell and up-sell

- Scalable Pricing: there are always some customers

that are willing to pay more for your product than others. The trick is

developing a multi-dimensional pricing matrix that allows you to scale

pricing for larger customers that derive more value from the product.

This could be pricing by the seat used (Salesforce.com), or by some

other metric such as number of individuals mailed in email campaigns

(Eloqua).

If you are using scalable pricing, it will be valuable to measure what the distribution is of customers along the various axes. You could imagine taking an action to do after more seats inside of existing customers as a way to drive more revenue. etc.

Drill down into Cash

We already discussed Months to recover CAC as a key variable. There is another way to affect Cash: which is using longer term contracts and incenting your customers to pay for 6, 12, 24, or even 36 months up front in advance. This can mean the difference between needing to raise tons of venture capital and giving away ownership, or being able to grow the business in a self-funded manner. Given the cost of capital, you can often calculate what discount makes sense. (If capital is cheap and freely available, it doesn’t make sense to give much discount.)

If you do use longer term contracts, it will be important to measure “Discretionary Churn”. Since some of your customers are locked in and cannot churn, they could artificially lower your overall churn numbers. The way to understand what is really going on is to look at the discretionary churn, which is the churn rate for all customers that are at the point where they have the option to churn, removing those whose contracts would have prevented them from churning.

Cash Management and forecasting

Cash is one of the most important items to get right in any startup. Run out of cash, and your business will come grinding to a halt regardless of how good any of your other metrics may be. One of the most important ways to run a SaaS company is to look at CashFlow profitability (not recognized revenue profitability). What is the difference: If your business only gets paid month by month, there will be no difference, but if you get longer term contracts, and get paid in advance, you will receive more cash upfront than you can recognize as revenue, so your cash flow profitability will look better than your revenue profitability, and is a more realistic view of whether you can survive day to day on the money coming in the door.

Here is another comment from Alastair Mitchell of Huddle on this topic: “SaaS companies tuning their model should think not just in terms of the months to recover CAC, but also the topline amount of cash required to get to cashflow profitability (or the next funding round). This is probably the single biggest mistake I see in early stage companies. They don’t look ahead, using these metrics, to figure out that if the time to repay CAC is 12 months, then in aggregate they are going to need 12 months of CAC spend PLUS the number of months required of further growth to cover their operating costs (mostly engineering) BEFORE they are even cashflow positive (let alone revenue profitability). Most businesses I see fundamentally miss this and end up short; frequently through under-estimating the time to recover CAC, and churn. The readers of this blog should be focused on cashflow profitability, not revenue profitability. (Hence why your point about annual/upfront contracts is so important)”

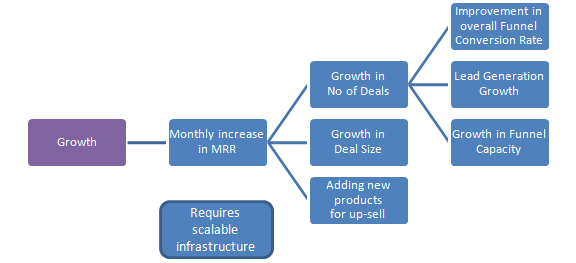

Drill down into Growth

Focusing on Growth as a separate parameter can be highly valuable. It is the nature of a SaaS business to grow MRR month on month, even if you only added the same number of customers every month. However your goal should be to grow the number of new customers that you sign up every month. You can do this by focusing on:

- Improvement in the overall funnel conversion rate

- Lead Generation Growth

- Growth in Funnel Capacity

The first two have been covered already. The last bullet: Growth in Funnel Capacity is an often overlooked metric that can bite you unexpectedly if you don’t pay attention to it. In my second startup, I had a situation where sales growth stalled after growing extremely rapidly for a couple of years. The problem, as it turned out, was that we had stopped hiring new sales people after reaching 20 people, a number that felt very large to me, and had maxed out on sales capacity. We started sales hiring again, and a couple of years later the business hit a $100m run rate. I witnessed a similar phenomenon at Solidworks, when after 2-3 years of phenomenal growth, their growth slowed. It turned out that their channel sales capacity had stopped growing. Solidworks started measuring and managing something that would later turn out to be a critical metric: channel capacity in terms of the number of FTE (Full Time Equivalent) sales people in their channel, and the average productivity per FTE. This has helped propel them to over $400m in annual revenues.

Another great way to grow your business is by adding new products that can be up-sold, or product features that can lead to a higher price point. Since you already have a billable contract, it is extremely easy to increase the amount being charged, and this can often be done with a touchless sale.

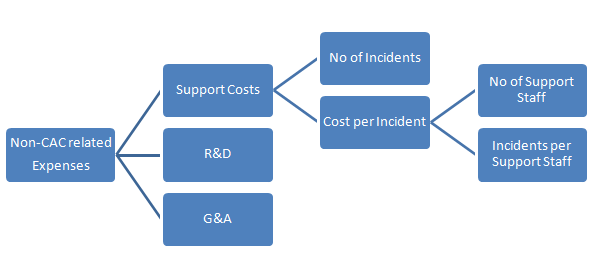

Other Metrics

There are a series of less important metrics that can still be useful to be aware of. I have listed some of these in the diagrams below:

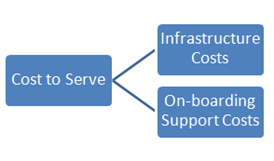

After posting the above, I received a note from Gail Goodman of Constant Contact, noting that they include the cost of on-boarding a customer in CAC, not LTV as I have shown. Given that they are a public company with significant accounting scrutiny, this is likely the right way to do things.

Conclusions

If you have kept reading this long, it likely means that you are likely an executive in a SaaS company, and truly have a reason to care about this depth of analysis. I would very much like to hear from you in the comments section below to see if I have missed out on metrics that you think are important.

The main conclusion to draw from this article, is that a SaaS business can be optimized in many ways. This article aims to help you understand what the levers are, and how they can affect the key goals of Profitability, Cash, Growth, and market share. To pull those levers requires that you first measure the variables, and watch them as they change over time.

It also requires that you implement a very metrics driven culture, which can only be done from the top. The CEO needs to use these metrics in her staff meetings, and those execs need to use them with their staff, etc. Human nature is such that if you show someone a metric, they will automatically work to try to improve it. That kind of a culture will lead to true operational excellence, and hopefully great success.

David Skok is a General Partner with Matrix Partners in Waltham, Massachusetts. This blog post was originally published on February 17, 2010. You can find this post, as well as additional content on his blog called For Entrepreneurs.