Google, now Alphabet, started out as a search engine and is today a multinational conglomerate with a market cap of over $500B. The company has expanded well beyond the original core search engine business and now owns multiple products and divisions like YouTube, Google Maps, Chrome, Android, and new hardware products. GV (formerly Google Ventures) is the organization’s venture arm and has made investments in companies like Uber, Slack, HubSpot, 23andme, and many others.

Back during the 90s dot-com era, there was a Boston-based company that was like an earlier version of what Google is today. It was an early adopter that pushed the limits of the internet, which at the time was the new frontier. This company played a major part in laying down the foundation for what the internet is today.

The company was revolutionary. It had a powerful search engine, many different innovative products, Eric Schmidt’s attention, and a venture arm.

This company was CMGi in Andover, Massachusetts.

Yes, this is the same company that had the original naming rights to the home of the New England Patriots, which at first was known as CMGi Field.

Unfortunately, along with the entire industry, the company had a rapid rise and then a massive collapse and became the poster child for the dot-com era.

Regardless of the stigma placed on the company, it is interesting to look back at all the innovative companies and products CMGi built or invested in. At its peak, the company had over 70 investments, 20 subsidiaries, 5K employees, and $1.5B in annual revenue. Its market cap was $41B and ranked somewhere around No. 7 - 9 in the world in terms of aggregate traffic to all of its properties.

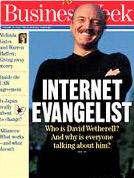

I’m fascinated by the history of Boston tech, so I decided to take a dive into the company’s history by interviewing David Wetherell, who was the Chairman and CEO of CMGi.

The History of CMGi

The company was originally known as CMG Information Systems before the name was shortened to CMGi. Wetherell became Chairman, CEO, and President after a leveraged buyout of the company in 1986. CMGi’s core business was focused on selling mailing lists of university faculty and information buyers to educational and professional publishers. After taking over, Wetherell built up the company’s revenue and market share, and the company went public in 1994. Shortly after its IPO, Wetherell founded BookLink Technologies, a web browser company, which was sold to America Online for an all-stock transaction that yielded $72M for CMGi from an initial $900K investment.

The proceeds from the sale of BookLink allowed CMGi to focus on a two-pronged strategy. It would incubate its own startup internet companies and also have an investment arm, CMG @Ventures, to fund other early stage internet companies. As the business and its portfolio grew, CMGi became a NASDAQ 100 company and market leaders like Microsoft, Intel, and Sumitomo held minority positions in it.

CMGi’s portfolio included companies like AltaVista, Engage, Lycos, GeoCities, Raging Bull, NaviSite, Furniture.com, MotherNature.com, MyWay.com, Snapfish, Yesmail, and many others. (We’ll have a slideshow on VentureFizz tomorrow digging deeper into the portfolio and how these companies were precursors to many of today’s major web products.)

In 2000, CMGi was working with Eric Schmidt, then-CEO at Novell along with Sun Microsystems and Compaq on a new initiative called CMGion. Each partner agreed to invest $20M and build a unified, global, internet-based network service, which ultimately would have been a competitor to Akamai and other Content Delivery Networks if the market didn’t collapse.

The venture arm made some great investments, but like most firms, there were ones that got away. For example, CMG @Ventures had the opportunity to invest in the first round of capital for eBay, but they couldn’t come to terms. eBay was profitable already, so it was looking for a pretty lofty valuation, which ended up being a small price to pay as compared to the ultimate value of the company.

According to Wetherell, Novell and CMGi were planning a merger and Eric Schmidt would have been CEO of the combined entity but the merger was put on hold when the market crashed during the spring of 2000. He also mentioned at one point CMGi discussed acquiring Google, but the board was against the idea.

AltaVista

One of CMGi’s major portfolio companies was AltaVista, one of the first major internet search engines. AltaVista was developed by researchers at Digital Equipment Corporation (DEC), and it was the Google of its time. In 1999, CMGi purchased 80 percent of the company from Compaq, which had acquired DEC, and transformed it into a web portal company to compete against Yahoo! and others.

AltaVista was set up to go public in 2000 right when the stock market crashed for tech companies, leading to the ‘internet bubble burst’, and CMGi was forced to delay the IPO. Even after the bubble had burst, AltaVista still had value and Wetherell believed that it could have enabled CMGi to remain a significant player in the internet space. After cutting costs, AltaVista still had $50M in revenue and was break-even. Even more valuable was the fact that AltaVista owned 50-60 key search engine patents, which Wetherell believed was worth more than what CMGi paid for the asset.

Google had serious momentum at this point and was quickly becoming the search engine behemoth that it is today. Despite challenges in the marketplace competing with Google, Wetherell argued to the board that the company should retain AltaVista because of the value of its patent portfolio, which would later yield value from Google in return for freedom to operate once it was ready to go public. The BOD was not convinced, and AltaVista was ultimately sold to Overture Services (later acquired by Yahoo!). It is believed that Yahoo! received in the vicinity of five percent of Google in exchange for the freedom to operate, which today is worth in excess of $25B.

The Fall

The dot-com bubble’s burst could have been avoided was it not for the Y2K / new millennium bug and a confluence of other factors, according to Wetherell. There was a great deal of fear and anxiety surrounding the Y2K bug which might have caused computers to crash and perhaps a run on banks. To counter this fear, the Federal Reserve Bank flooded banks with $60B of liquidity to make sure the banks had enough cash to keep operating in the event of such a run.

Once the turn of the century occurred, and there was no run on the banks, the Fed feared that the extra liquidity would prove to be inflationary, despite the fact there were no signs of inflation. To counter this inflationary concern, the Fed raised interest rates six times in six months. This, in turn, caused the IPO market to shut off, leading to the market crash, and venture capital, the lifeline of early stage internet companies, dried up. It ended up being a perfect storm of events which maybe didn't need to happen at all and could have saved the industry from such an abrupt downward turn.

It was a tough time for CMGi and the rest of the tech industry. There were a lot of tough decisions. Companies folded, people lost jobs, and investments lost value. Quickly, $20B in CMGi’s public market portfolio lost value.

Surprisingly, CMGi did survive the dot-com collapse, as they focused on a core of six internet companies, including AltaVista. Then, with the attacks of 9/11, the stock market crashed again, which put additional pressure on the company. The BOD made the decision to jettison its internet businesses, the last of which was AltaVista.

So, what is Wetherell up to now? After retiring from CMGi, Wetherell took his background in the high tech industry and applied it to something that had more meaning for him: life sciences. He started out as a sole angel investor, and it blossomed into an investment firm with $200M under management, called Biomark Capital. The firm has invested in a dozen leading edge Biotech and healthcare companies, and he finds the firm’s work extremely gratifying.

Keith Cline is the founder of VentureFizz. Follow him on Twitter: @kcline6.