The investors have given their two (probably blockchain/cryptocurrency-based) cents on the blockchain and cryptocurrency sector in Boston in Part 2 and a handful of them spoke about industries and companies that are getting involved.

But, what else is going on? And, more interestingly, who are the other startups and entrepreneurs getting involved with this space here in Boston?

Our deep dive into the blockchain and cryptocurrency scene in Boston continues, as we enter Part 3 and profile a collection of startups utilizing blockchain and cryptocurrency technology. This isn’t a complete list per say, as many of the startups in this sector are still in stealth mode.

I had a chance to speak with multiple entrepreneurs, all of which had different career backgrounds. Some ranging from first-time founders to serial entrepreneurs. However, each company carries a common trend with how each founder views the technology as disruptive. Since blockchain/cryptocurrency tech is open source, entrepreneurs and engineers have taken it upon themselves to build unique applications for an abundance of industries.

Sia

I profiled Sia in June 2017, and they were the first blockchain and cryptocurrency-based company I came across in Boston.

Sia Co-Founders David Vorick and Luke Champine had a growing interest in Bitcoin, and wanted to create a “better version of it.” While they couldn’t find anything fundamentally wrong, the two engineers started to look closely at the blockchain technology behind it and found how it can be administered for other applications. Vorick and Champine took into account how a blockchain is decentralized, and how it can be applied to data storage.

The two have developed an open source network where users can buy one TB of cloud storage space for a low, low price of $2 per month. Sia’s users can also host data in exchange for the platform’s own cryptocurrency, Siacoin. The data is highly secure and redundant, as it is broken down into several encrypted pieces across the company’s blockchain. If a hacker were to attempt to steal or distort the data, they wouldn’t be able to, since said data will be encrypted and spread throughout several locations.

“Right now, cloud storage is about $20 per terabyte per month, but it will cost more if you want to store across multiple locations,” said Zach Herbert, Sia’s Head of Operations. “I was shocked by Sia’s price of $2 per terabyte. It’s almost the complete opposite of what, say, Amazon is doing. It’s an order-of-magnitude reduction.”

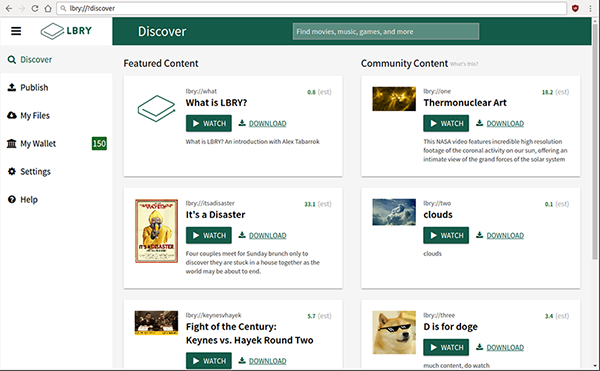

LBRY

LBRY is a web protocol designed for content creators to share their work through a decentralized network. LBRY users can upload video, audio, pictures, and written work to the protocol the content can be spread across to a wider audience. Users can purchase other users’ content by using the company’s LBRY Credits, which can be downloaded right from the web browser.

Currently, LBRY has a focus on video content, specifically YouTubers who are frustrated with the recent drops in views and lack of audience growth. Several popular YouTubers are on LBRY, including Dave Rubin, GradeAUnderA, and Casually Explained.

The company is the brainchild of Jeremy Kauffman, Josh Finer, Jack Robison, and Jimmy Kiselak. Kauffman was an early adopter of Bitcoin back in 2013 after a friend introduced him to the cryptocurrency. After becoming more entrenched in the culture surrounding it, Kauffman became more interested in some of the other aspects of cryptocurrency.

“I was reading a conversation between [Alphabet Executive Chairman] Eric Schmidt and Julian Assange about the applications of Bitcoin to information distribution,” Kauffman said. “What made me interested in learning more about it was the fact that it was decentralized. I began asking myself ‘What other things can be decentralized?’”

In 2016, Pillar led a seed round into Kauffman’s startup and they have remained active within the cryptocurrency/blockchain space in Boston.

LBRY was another startup I profiled last October. Since the initial interview, the company has grown to 14 full-time employees, and they are currently working on a mobile version of the protocol, which is set to release in February.

Tengu

Tengu Founder and CEO Chet Manikantan is a serial entrepreneur who has worked in all different fields of technology, including edtech and FinTech in his hometown of Bangalore, India. He became interested in Bitcoin back in 2009 as more or less a hobby.

“It stemmed from an academic interest,” said Manikantan. “I started to follow forums and eventually downloaded the software. I began mining coins on a laptop and that was that for a little while.”

Manikantan was re-introduced to cryptocurrency in 2015 when taking part in a Global Entrepreneur-in-Residence Program and discovered the MIT Bitcoin Club. From there, his newfound interest became Bitcoin and what can be put to use with this form of technology.

“I’m always looking for projects with a meaningful impact,” Manikantan said. “Blockchain and cryptocurrency technology is perfect for solving many problems. Take, for example, the Equifax hack. All of that data was stored in one space and not encrypted.”

“Your credit score should travel from service to service, and Tengu was born out of this idea,” Manikantan adds.

Tengu is an early-stage startup developing a FinTech service that Manikantan describes as a “decentralized Equifax.” Something interesting to point out is that records will be kept on the company’s own blockchain, which was developed from scratch over the course of nine months. Tengu will record a user’s financial transactions, as well as unconventional variables including non-financial transactions, and allow them to see their credit score based on these actions. These will be placed on the startup’s global blockchain and will allow the records and credit score to travel from user to user.

Currently, Tengu is being tested within the company and is set for a release in March.

And for those who are curious where the name came from, Manikantan told me it comes from various sources.

“Tengu is a rough translation from ‘tree of life’ in several Indian languages, but also in the Shinto religion in Japan, the Tengu was the God of Prosperity,” said Manikantan. “Another way of looking at it is since we deal with P2P sharing, you could say it takes two to Tengu.”

Voatz

In the last U.S. Presidential Election, the overall voter turnout had, as reported by CNN dropped from 64% of voting-age citizens turning out for the 2012 election, but in 2016, it was 53.5%. There were several reasons stated to explain said drop off, including inconvenient polling locations, a lack of knowledge of where candidates stand, or not having interest.

Founded in 2014 by Nimit Sawheny, Voatz is looking to change that. The startup has developed a smartphone application to enable voters to participate in elections. The company’s app uses a mix of biometrics and blockchain-based technology in order to keep the voting process anonymous—without having to go into one of those booths. By using the blockchain, Voatz is able to store their voting data in a far more concise manner, but not have said data compromised by miscalculations in the polls.

Voatz has maintained a busy schedule over the past year, as the company graduated from Techstars Boston before being immediately accepted into the MassChallenge cohort in 2017. Voatz made headlines at the start of this year, with their announcement of a $2.2 million seed round led by Medici Ventures.

Esprezzo

![]()

In December 2017, the monthly Boston ICO Meetup group invited CampusTap Founder and CEO Remy Carpinito to speak about his newest startup, Esprezzo. A recently founded blockchain/cryptocurrency-based startup, Esprezzo is bringing something to the space that will certainly be needed if more entrepreneurs are working with this technology.

Esprezzo is a Blockchain-as-a-Service (BaaS) provider that will help blockchain developers fill in the blanks where they are having trouble creating applications. The company also offers tools for blockchain-related projects, such as framework management and front-end development.

“There are endless opportunities to produce applications using this tech. We are working on producing the middleman,” Carpinito told me. “We want to put the power back with the user.”

Carpinito and Alan "AJ" Wilhelm both got involved with Bitcoin mining when it was still a new concept within the cryptocurrency world.

“My CTO [Wilhelm] and I are pure technologists,” said Carpinito. “We each have an understanding of this technology and know where it can fit in the market. AJ is enamored by the blockchain.”

He saw the potential of the underlying technology and wanted to implement it into his current company. Carpinito had an idea for CampusTap that would involve moving student IDs to a private blockchain but found a lot of complications with a school’s security protocols.

So he, and a third of the team at CampusTap decided to take a chance and spin-out into a new startup.

Commonwealth Crypto

Besides Bitcoin and Ether, there are dozens and dozens of other cryptocurrencies out on the market each with their own user base. With several types out there each with their own market price, would-be buyers and traders would want to get their hands on them.

Commonwealth Crypto is currently developing technology that empowers those who are trading or exchanging on a cryptocurrency platform, (such as Coinbase) to trade without having their coins lost or stolen. Commonwealth Crypto is compatible with most forms of Bitcoin, as well as Litecoin and ZCash.

“Commonwealth Crypto’s tech prevents custodial ownership and theft,” said Richard Dulude of Underscore VC, who led Commonwealth’s seed round last December. “It’s infrastructure for crypto trading where they can connect every wallet to every exchange that is on the blockchain.”

The company’s founding team, Sharon Goldberg, and Ethan Heilman, have been deeply involved with network security and cryptocurrency/blockchain throughout their respective careers. By creating a security protocol for buyers in the cryptocurrency space, Commonwealth Crypto is enabling those who are new to this space to become more involved with it.

AirFox

Finding quality mobile and/or Internet service in a particular area overseas can be a bit of a challenge. Founded in 2016, AirFox is giving options for wireless carriers that are not sold to the public. AirFox users will be able to access the Internet through an Android-enabled device, by inserting a chip into their phone or tablet.

The company’s Co-Founder and CEO Victor Santos analyzed mobile and web markets overseas and saw the ongoing trend of people who are enabled for the Internet but unable to log on.

“If we have access to these people, how do we give them more access?” VP of Business Operations Christine To asks. “Internet is expensive, and for those who cannot access it, they cannot participate in the digital economy.”

AirFox was one of the first venture-backed companies to raise millions off of an ICO and now have their own utility token, AirToken. AirToken is based on Ethereum and can be used to purchase mobile airtime, data, and internal currency on the platform.

FirstBlood

Similar to cryptocurrency and blockchain, esports is growing in popularity; both had underground, almost cult-like followings, and are now receiving more mainstream coverage.

Founded by Boston blockchain community members Joe Zhou, Anik Dang, Zack Coburn, Marco Cuesta, and Daniel Temkin, FirstBlood is, currently, the only blockchain-based startup in Boston that is getting involved with esports.

The startup has developed a platform that is designed to support the esports ecosystem by allowing up-and-coming players to create a profile and play with others. Those who sign up will be rewarded with the platform’s own token, which can be used to reward other players.

“One of our goals is to reward those going on their esports journey,” said FirstBlood Community Director Auryn Macmillan. “We want to make it a more accessible experience for up-and-coming players.

For those who pay attention to esports, they know certain communities will contain not-so-friendly behavior with certain players, especially in the Multiplayer Online Battle Arena (MOBA) genre that FirstBlood concentrates on. For those engaging in toxic behavior, the platform will subtract tokens from their balance. There is more of an incentive to actually play fair, which is something any gamer would be happy to hear.

“We went with the MOBA genre because there is a lot of room for improving the player experience,” Macmillan told me.

FirstBlood’s beta platform was launched in July, and still undergoing quality assurance testing before opening itself up to more users. The platform can be implemented with the MOBA game DOTA 2.

“It was the first game we chose since it already has a massive community. It also has an open API to implement FirstBlood with,” said Macmillan. “However, we do plan to expand and branch out into other esports. Expect a couple of surprises on the horizon.”

Cognate

“My parents are trademark lawyers, so I learned a lot about trademark law at the dinner table, whether I wanted to or not,” said Cognate CEO and Founder Bennett Collen. “I was originally an environmental science major, but I got sucked back in.”

Cognate is a platform built from the Ethereum blockchain, and it utilizes the smart control protocol in order for SMBs and startups to store trademark and promotional information. Users will write-up the information regarding trademarks, including logos, slogans, and domain names, which, in turn, can be accessed by trademark lawyers when cases involving infringement or bootlegs come up.

However, Cognate wasn’t always built off of Ethereum, and they went through the classic early-stage pivot. Collen was introduced to the cryptocurrency world through the Blockchain at MIT event in 2016. While he heard about Bitcoin, he started to understand the blockchain technology behind it, and how it can be applied to his business.

“It wasn’t so much a business pivot, but more of a tech pivot. The immutable data, along with the timestamps, really helped drive the point home for me,” said Collen. “After about a month of conviction, I convinced myself and our CTO to make the switch. I didn’t do it for the buzzwords; I did it because the technology elegantly solved this problem.”

Adjoint

Adjoint is a team of financial sectors veterans. Co-Founder and CEO Havell Rodrigues worked as a hedge fund manager for most of his career; Co-Founder and VP of Product Darren Tseng worked at the FinTech startup, Elsen; Co-Founder and CTO, Stephen Diehl previously worked on projects at Wall Street banks; and the company’s COO, Somil Goyal, worked at Deutsche Bank. Adjoint is tackling a market in need of innovation and disruption: B2B enterprise services.

“We are excited about blockchain applications, but we want to focus on B2B,” said Rodrigues. “We want to solve problems as entrepreneurs, and blockchain tech can solve several problems enterprise companies face.”

The platform they developed, Uplink, which is its own blockchain solution built from scratch for the enterprise market, is designed to allow companies to implement private, permissioned blockchains and smart contracts. Rodrigues jokingly describes it as “Wicked Smaht Contracts for the Enterprise market.”

“Adjoint has built a general purpose platform, but it can be tweaked for certain applications for banking, capital markets, insurance, and commodities trading,” he said. “For example, insurance companies can use it to automate transactions between themselves, their service providers and reinsurers.”

While this is the first time Rodrigues has founded a company that works with blockchain technology, he has been intrigued by blockchain since 2012.

“I am enamored with the underlying technology and what it can do,” the CEO said. “There’s a lot of noise and it’s tempting to go down the rabbit hole. For now we are focussed on helping large enterprises reduce costs in their operations or invent new revenue streams ”

The company has received angel funding from a variety of prominent investors including Joe Caruso, Jere Doyle, Diane Hessan, Timothy McSweeney, Bob Stringer from Crimson Seed Capital, and Prasanna Gopalakrishnan, the Chief Information Officer of Boston Private Bank.

Tune in next week...same blockchain time, same blockchannel...for the last time

Throughout the last three parts of this series, our readers have read a handful of predictions on what is to come with the space from both entrepreneurs and investors.

In our grand finale, “Newest Industry” there will be predictions, and even more close insights, about the cryptocurrency/blockchain scene in Boston.

Colin Barry is a contributor to VentureFizz. Follow him on Twitter @ColinKrash.

Images courtesy of Sia, LBRY, Tengu, Voatz, Esprezzo, Commonwealth Crypto, AirFox, FirstBlood, Cognate, and Adjoint.