Jo Tango is a Partner and Founder of Kepha Partners, an early stage (pre-seed, seed, Series A) VC firm. He has been investing in and financing tech companies in the Boston area since 1998, and has a proven track record of success with several exits. He has obviously built a very successful career as a VC in terms of working with founders and helping them down the path to a successful exit. But there's also very fun story that Jo shares about how his career path almost took a different direction with a company called Amazon in its earlier days.

Where did you grow up?

I’m an immigrant. We moved from Indonesia, where there’s a lot of discrimination against ethnic Chinese people, and landed in Queens and then Brooklyn. It was a rough part of town, but we didn’t have many options. We arrived with only $1,500. After seven years, we moved to California.

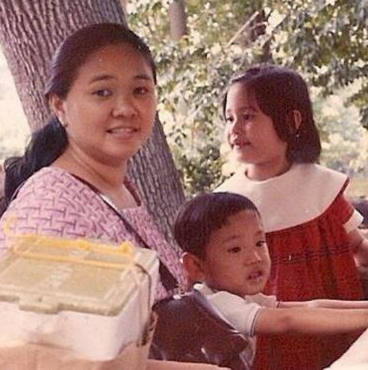

Jo at age 2 with his mother and sister, shortly after moving from Indonesia.

What prompted you to attend Yale? What did you major in?

I majored in economics and political science in college. I chose Yale because I got a good vibe when I visited. People were really friendly and I felt at home there. I went to a regular high school and applied to colleges sight unseen. I was the first kid in my high school to get into Yale and so when I hear of the many college visit trips kids do today, it’s a pretty foreign concept to me. My college counselor was an assistant coach for our football team. It was a very naive and basic application process.

Jo during his college years at Yale.

What did you do right after your undergraduate degree?

After college, I worked in investment banking and then management consulting. So, it was a pretty boring and very mainstream corporate track.

What prompted you at attend HBS?

I applied to HBS while in college on a lark. They didn’t take the GMAT back then and they used to have a program whereby they would accept you and reserve a slot for you, as long as you worked somewhere after college for just a year. I don’t test well and so I figured, why not? So, yeah. I applied to HBS to avoid taking the GMAT.

Tell me about your experience at Bain & Company.

Bain & Co. was great. I worked there before and after business school, and was based in Boston, Hong Kong, and Singapore. I ate some really weird stuff in Asia. Also, I learned a lot about working with clients, doing a lot of analysis, and working very long hours.

How did you get into venture capital and join Highland Capital Partners?

I was offered a promotion at Bain, but it came with a two year commitment. I didn’t want to lie, nor did I want to be a partner at Bain. So I quit. I wanted to be a vice president of business development at a start-up, and started networking.

I almost took a job reporting to Jeff Bezos at Amazon.com. A guy named John Doerr called me at home to recruit me. I didn’t really know back then who John and Kleiner Perkins were. Duh. My Amazon.com job was to be chief of staff, help figure out what verticals to enter (they were only in books then and still a young company), and - eventually - run one of the new verticals.

Back then, my wife and I had one baby and we visited Seattle. I told her it would be a 10-year commitment, as it would be a major commitment to Amazon.com, and if I did well I would likely be recruited to other Kleiner Perkins companies. She thought about it and politely said: “I can make this work if you want me to, but Boston is where I feel at home.” So, we turned down the offer. To this day, I tell her she is my “$100M spouse”.

After that, I focused on looking for a Boston job and started cold-calling and cold-emailing people from the HBS directory. I met up with some incredible entrepreneurs and called on a few VCs to get leads to their portfolio companies. CRV and Greylock, for example, were really helpful.

Highland had a few HBS alumni and so I wrote them to get leads, too. Ironically, the day before my meeting at Highland, I almost decided to cancel it, as I was about to accept an offer to be at DataSage (later sold to Vignette for $700M). But on a hunch, I decided to keep the meeting.

The long and short of it is that Highland was kind enough to offer me an open-ended job, saying that I should try VC and if I didn’t like it, to be an entrepreneur in residence or start a company with them. My head was whirling, as this wasn’t expected. But I figured I had nothing to lose. So, I went there and thought it would be for a few years. Then over eight years went by.

What companies did you invest in during your time at Highland?

My investments there included: Bit9 (now Carbon Black), ExaGrid, StreamBase Systems (acquired by TIBCO), Vertica Systems (acquired by Hewlett-Packard), Ask Jeeves (NASDAQ: ASKJ), Digital Market (acquired by Agile Software), and NextCard (NASDAQ: NXCD). Two of those investments, StreamBase and Vertica, were with Mike Stonebraker, the MIT Professor who last year won the $1M Turing Award, the Nobel Prize equivalent in computer science.

You’ve been an investor in the Boston tech scene since 1998. How has the ecosystem evolved since then?

I think it is a much more experienced group of entrepreneurs. So much info is out there on blogs and social media, as well as from all of the incubators and programs. Before, entrepreneurs networked with each other in the old-fashioned, one-on-one way. Now, there is the “one to many” way, with tremendous scale and a plethora of opportunities.

Do you have any interesting or fun stories to share from the web 1.0 bubble years?

I remember well all of the IPO selection meetings, where famous investment bankers and analysts would pitch us on why they should be picked to underwrite the IPO. I remember one very famous analyst telling us that we should up the spend at the company to prove that we were going for scale. “The more money you spend, the higher your market cap will be,” we were told.

I remember companies with $3M in revenue being sold for $3B. I remember VCs looking down at $500M exits, as they were viewed as very small outcomes. I remember money raining from the skies and completely changing people’s lives. It’s as though they won the lottery, except that the lottery pay outs were happening nearly every day to many people all around you. I remember money dramatically changing some people - sometimes for the worse.

I laugh now when I think of those times. The laws of finance were reversed back then. The cost of capital was negative. You were rewarded for overspending. The web 1.0 bubble was like a great party that then got out of control after someone raided the liquor cabinet and we all paid in spades with a massive and very long hangover.

It’s a lesson I never forgot when the web 1.0 bubble burst and collapsed in flames. Capital markets will turn on a dime, and you just have to remain calm and neither get too up or down when the stock market makes its moves. In the end, entrepreneurs need to focus on creating companies that not only sell a product, but are in fact a business. The capital markets will come and go.

As a VC, you simply cannot follow the herd.

How has venture capital changed or evolved over the years from your days at Highland to today at Kepha?

I think there’s much more power with the entrepreneur. The balance of power has shifted dramatically. Before, entrepreneurs used to find names and addresses of VCs in a big directory called Pratt’s, which was really expensive. Then they mailed in letters and business plans. Now, there’s social media and you pretty much can get to any VC at any time. It’s much more democratic.

Unfortunately, it also is a smaller VC market. Many firms have moved west, closed, or been inactive.

What prompted you to move on from Highland and start Kepha Partners?

It just felt like it was time. I was in my mid-30s and I wanted to start something from scratch. My brother-in-law was 42 years old when he died suddenly and without warning, and my mother was only 60 years old when she passed. I learned that time is very precious.

And I wanted to avoid a potential life regret. You see, I had asked Jeff Bezos this question: why did you leave a high-paying hedge fund job, pack everything in a van, and leave NYC for Seattle to start an online book store? He said that he wanted to avoid life regrets and that he had read that people at the end of their lives regret more “acts of omission” not “acts of commission.”

In other words, when you’re 80, you don’t regret usually what you did do. It’s what you did not do that may haunt you. I’ve since read about that study. Someone interviewed people in nursing homes. It’s a very sobering set of data.

I never forgot Jeff’s words. So, as I contemplated branching off and doing my own thing, I decided that it would be a huge bummer if I didn’t at least try. So I thought about it and then did what I did years earlier when I was at Bain: I decided to leave and to go for it. That’s how I became an entrepreneur and started Kepha.

It was a fun, challenging, and emotionally trying effort. 2007 was a different time. There were almost no new firms gettings started then, as there are now. I fundraised alone. Some investors thought I was crazy. Some were pretty rude. I felt like a piece of meat at some meetings.

But, many investors seemed intrigued and decided to do some research on my belief that early stage VC was best practiced in small, focused, boutique-like groups. I said that early stage VC should be like Navy SEAL teams: you needed to be fast and agile and be comprised of very experienced investors. That’s why we’re an equal partnership for the investors and we have no junior staff. A team effort here. We all share rolodexes and opinions to help our entrepreneurs.

I also hold a firm belief in a Mission and Operating Principles. They’re on our website and in each person’s office. I hear that’s pretty unique in VC. I think company culture exists and needs to be managed. You can have a positive culture or a dysfunctional one. I feel our values really bind together our team and set the tone for how we behave with our entrepreneurs, our investors, and each other at Kepha.

Thankfully, it all worked out. Fund One closed 3x oversubscribed in six months. A few years later, we closed Fund Two in a few months, with our insiders stepping up in a big way, and also adding two additional large institutional investors. We now manage almost $200M, which is a lot, considering there are only two of us here investing.

The TL;DR is this: other than my children, starting Kepha has been the most rewarding experience for me. I really love our entrepreneurs, our investors, and my partners. I really want them to do well.

What stage of investments do you primarily target?

Early. We start at the pre-seed, seed, or series a levels. Ideally Boston - at least eastern seaboard. That’s our mission.

What are the top traits you look for in terms of investing into a company or founder?

I ask the question: “why do you work?”. I find that the best entrepreneurs have drive that is almost super-natural. They need to leave their mark on something, they need to control their environment rather than being an employee for someone else. And sometimes, there are positive root causes: a parent was a successful entrepreneur, for example. Sometimes, there are negative root causes - poverty in childhood and/or trauma - that propels this person to be proactive. Perhaps, a prior feeling of helplessness that this person never again wants to experience.

So as a VC, I think it’s important to know what motivates someone, why they work, and why they will exert a great deal of effort to achieve something incredible.

Regardless, I really marvel at how human beings can use the past and leverage it in the present. The ability to create, lead, and “be right” is a powerful instinct.

What sectors of technology, industries, or trends are of interest to you?

Well, we do only technology: no life science, no hardware, no chips, no “big” infrastructure such as cleantech. So we tend to invest in B2B companies (VoltDB) or B2B2C (OwnerIQ). Pure B2C companies are a rarity for us.

What is the current fund that you are investing from?

We are currently investing out of Fund 2. We have plenty of money, so please contact us!

Which investments at Kepha Partners are you involved in?

-

Azuki (sold to Ericsson)

-

Goby (sold to Navtech; 3rd Stonebraker company)

-

VoltDB (4th Stonebraker company)

-

Paradigm4 (5th Stonebraker company)

-

Apliant (not announced)

What excites you about the Boston market?

There’s incredible IQ in Boston. So many accomplished people are here and there is such an incredible genuineness to everyone. I think it’s a big enough market to have scale, but a small enough market so that people have to “play nice” with each other.

Since 1998, what companies have you passed on that you wish you hadn’t?

Amazon.com (see above)

Also, Ironport. An HBS classmate - Scott Weiss, who’s now at a16z - sold it for over $1 billion. I’ll stop there or I’ll start to cry.

Who do you admire or who has been the greatest mentor for you?

Gosh, I’ve had so many. I do not have one mentor, as I feel mentors are specialists: different people have different perspectives for different topics. I do have an informal Advisory Board, consisting of:

-

My sister

-

My executive coach

-

Some fellow members of a men’s discussion group. We’re all in business, have families, and belong to the same Catholic parish.

I find that these people know me very well and will shoot very straight with me. I’ve also found that they’re genuinely interested in giving me the best advice I need to hear vs. the advice I want to hear vs. wanting to hear themselves talk.

Outside of being a VC, what are you personal interests or activities?

We have a large family. That takes up a lot of time and is both fun and a huge commitment. In addition, fly fishing, writing my blog posts at jtangoVC.com, cooking, and reading (which I do often, as we don’t have TV in the house). I also exercise every day. But, honestly, right now, it’s all about my family and Kepha. Plenty of time later in life for major activities, hopefully.

Jo with his wife and children.

What type of music do you like?

I like baroque and jazz. Play some John Coltrane, hand me a bourbon, and I’m in a groove and very happy.

What was the last concert you went to?

Hillsong United.

What are some recent books you’ve read?

“Sapiens”, “Hitlerland”, “The Surrender Experiment”, and “Untethered Soul”.

Last movie you saw?

“The Big Short”. It’s very well done. After seeing it, you’ll be tempted to “Feel the Bern.”

Are you involved in any charitable organizations?

Currently, The Roxbury Latin School. We limit the number of charities with which each of us participates.

Keith Cline is the founder of VentureFizz. Follow him on Twitter: @kcline6.

![[Investor Q&A] Jo Tango of Kepha Partners: At Home in Boston banner image](https://venturefizz.com/sites/default/files/jo_tango_kepha_partners_masthead.png)