“If you cannot measure it, you cannot improve it” – Lord Kelvin

This article is a comprehensive and detailed look at the key metrics

that are needed to understand and optimize a SaaS business. It is a

completely updated rewrite of an older post.

For this version, I have co-opted two real experts in the field: Ron

Gill, (CFO, NetSuite), and Brad Coffey (VP of Strategy, HubSpot), to add

expertise, color and commentary from the viewpoint of a public and

private SaaS company. My sincere thanks to both of them for their time

and input.

SaaS/subscription businesses are more complex than traditional

businesses. Traditional business metrics totally fail to capture the key

factors that drive SaaS performance. In the SaaS world, there are a few

key variables that make a big difference to future results. This post

is aimed at helping SaaS executives understand which variables really

matter, and how to measure them and act on the results.

The goal of the article is to help you answer the following questions:

- Is my business financially viable?

- What is working well, and what needs to be improved?

- What levers should management focus on to drive the business?

- Should the CEO hit the accelerator, or the brakes?

- What is the impact on cash and profit/loss of hitting the accelerator?

(Note: although I focus on SaaS specifically, the article is applicable to any subscription business.)

What’s so different about SaaS?

SaaS, and other recurring revenue businesses are different because

the revenue for the service comes over an extended period of time (the

customer lifetime). If a customer is happy with the service, they will

stick around for a long time, and the profit that can be made from that

customer will increase considerably. On the other hand if a customer is

unhappy, they will churn quickly, and the business will likely lose

money on the investment that they made to acquire that customer. This

creates a fundamentally different dynamic to a traditional software

business: there are now two sales that have to be accomplished:

- Acquiring the customer

- Keeping the customer (to maximize the lifetime value).

Because of the importance of customer retention, we will see a lot of

focus on metrics that help us understand retention and churn. But first

let’s look at metrics that help you understand if your SaaS business is

financially viable.

The SaaS P&L / Cash Flow Trough

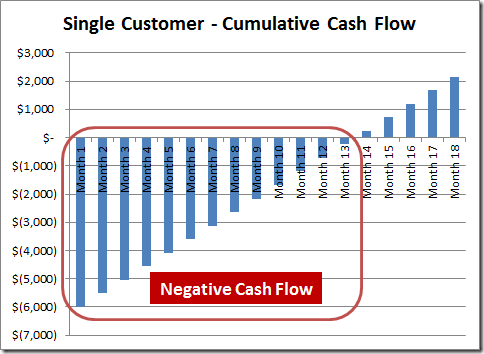

SaaS businesses face significant losses in the early years (and often

an associated cash flow problem). This is because they have to invest

heavily upfront to acquire the customer, but recover the profits from

that investment over a long period of time. The faster the business

decides to grow, the worse the losses become. Many investors/board

members have a problem understanding this, and want to hit the brakes at

precisely the moment when they should be hitting the accelerator.

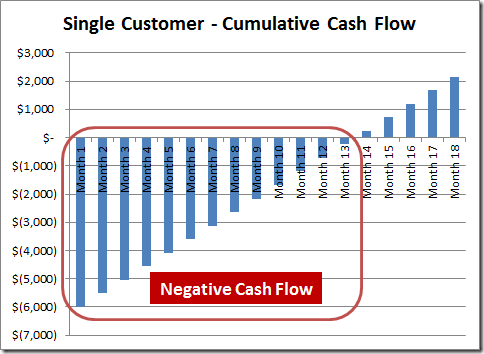

In many SaaS businesses, this also translates into a cash flow

problem, as they may only be able to get the customer to pay them month

by month. To illustrate the problem, we built a simple Excel model which

can be found here.

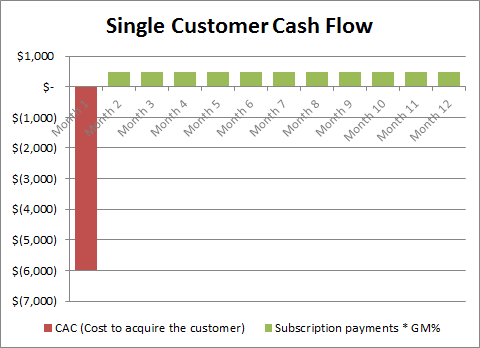

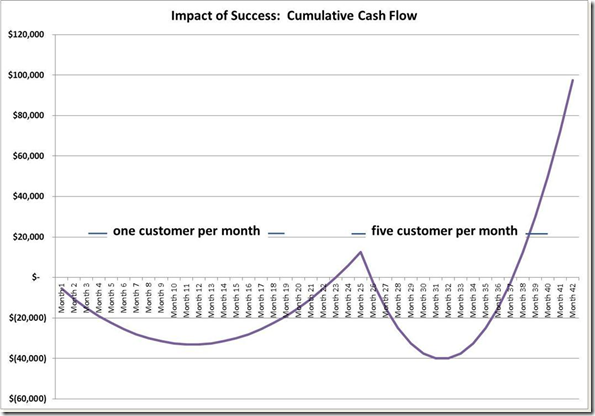

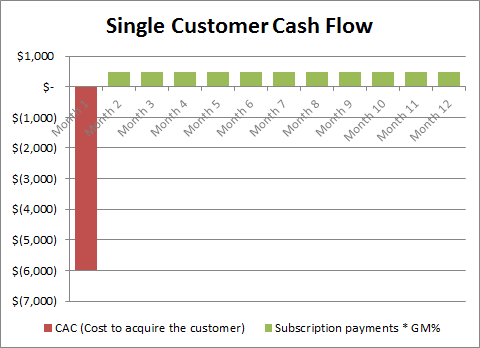

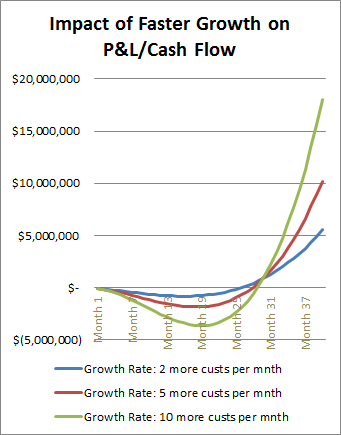

In that model, we are spending $6,000 to acquire the customer, and

billing them at the rate of $500 per month. Take a look at these two

graphs from that model:

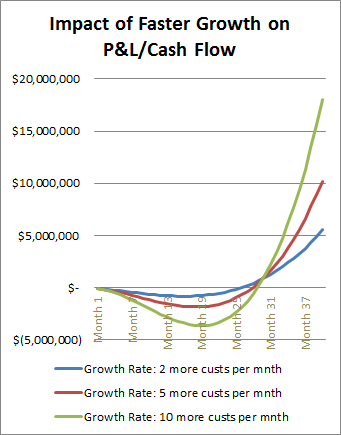

If we experience a cash flow trough for one customer, then what will

happen if we start to do really well and acquire many customers at the

same time? The model shows that the P&L/cash flow trough gets deeper

if we increase the growth rate for the bookings.

But there is light at the end of the tunnel, as eventually there is

enough profit/cash from the installed base to cover the investment

needed for new customers. At that point the business would turn

profitable/cash flow positive – assuming you don’t decide to increase

spending on sales and marketing. And, as expected, the faster the growth

in customer acquisition, the better the curve looks when it becomes

positive.

Ron Gill, NetSuite:

If plans go well, you may decide it is time to hit the

accelerator (increasing spending on lead generation, hiring additional

sales reps, adding data center capacity, etc.) in order to pick-up the

pace of customer acquisition. The thing that surprises many investors

and boards of directors about the SaaS model is that, even with perfect

execution, an acceleration of growth will often be accompanied by a

squeeze on profitability and cash flow.

As soon as the product starts to see some significant uptake,

investors expect that the losses / cash drain should narrow, right?

Instead, this is the perfect time to increase investment in the

business. which will cause losses to deepen again. The graph below

illustrates the problem:

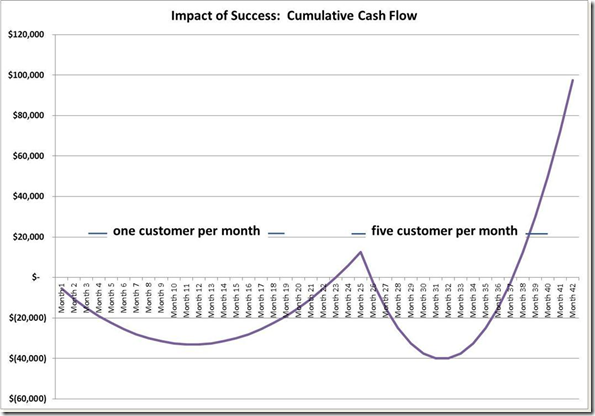

Notice in the example graph that the five customer per month

model ultimately yields a much steeper rate of growth, but you have to

go through another deep trough to get there. It is the concept of

needing to re-enter that type of trough after just having gotten the

curve to turn positive that many managers and investors struggle with.

Of course this a special challenge early-on as you need to

explain to investors why you’ll require additional cash to fund that

next round of acceleration. But it isn’t just a startup problem. At

NetSuite, even as a public company our revenue growth rate has

accelerated in each of the last three years. That means that each annual

plan involves a stepping-up of investment in lead generation and sales

capacity that will increase spending and cash flow out for some time

before it starts yielding incremental revenue and cash flow in. As long

as you’re accelerating the rate of revenue growth, managing and

messaging around this phenomenon is a permanent part of the landscape

for any SaaS company.

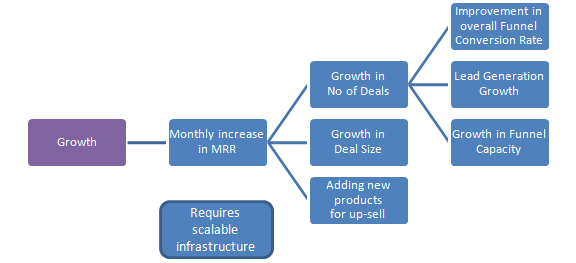

Why is growth important?

We have suggested that as soon as the business has shown that it can

succeed, it should invest aggressively to increase the growth rate. You

might ask question: Why?

SaaS is usually a “winner-takes-all” game, and it is therefore

important to grab market share as fast as possible to make sure you are

the winner in your space. Provided you can tell a story that shows that

eventually that growth will lead to profitability, Wall Street,

acquiring companies, and venture investors all reward higher growth with

higher valuations. There’s also a premium for the market leader in a

particular space.

However not all investments make sense. In the next section we will

look at a tool to help you ensure that your growth

initiatives/investments will pay back: Unit Economics.

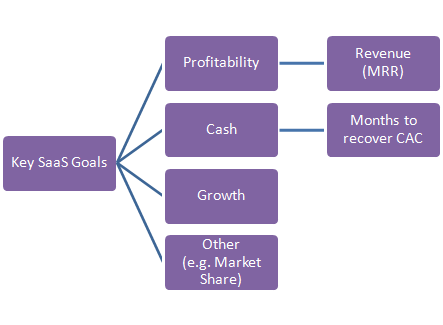

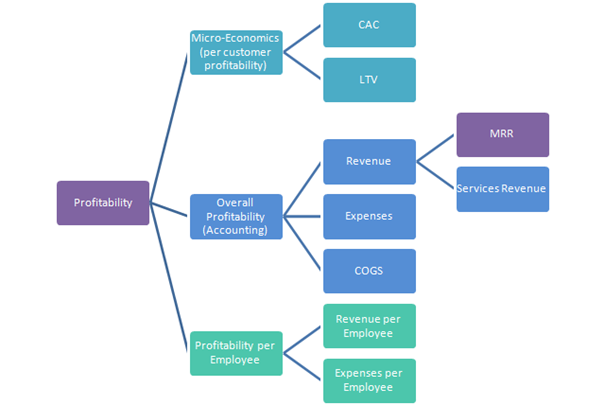

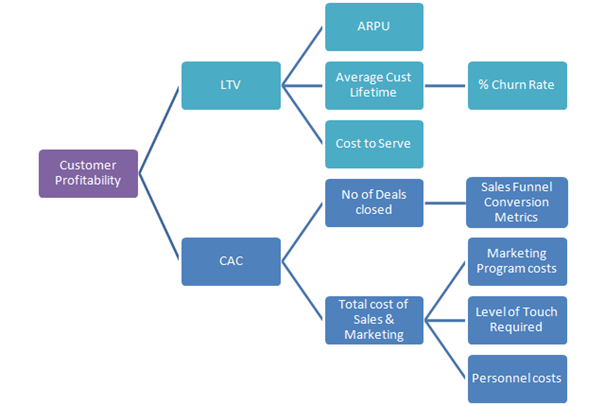

A Powerful Tool: Unit Economics

Because of the losses in the early days, which get bigger the more

successful the company is at acquiring customers, it is much harder for

management and investors to figure out whether a SaaS business is

financially viable. We need some tools to help us figure this out.

A great way to understand any business model is to answer the following simple question:

Can I make more profit from my customers than it costs me to acquire them?

This is effectively a study of the unit economics of each customer. To answer the question, we need two metrics:

- LTV – the Lifetime Value of a typical customer

- CAC – the Cost to Acquire a typical Customer

(For more on how to calculate LTV and CAC, click here.)

Entrepreneurs are usually overoptimistic about how much it costs to

acquire a customer. This probably comes from a belief that customers

will be so excited about what they have built, that they will beat a

path to their doors to buy the product. The reality is often very

different! (I have written more on this topic here: Startup Killer: The Cost of Customer Acquisition, and here: How Sales Complexity impacts CAC.)

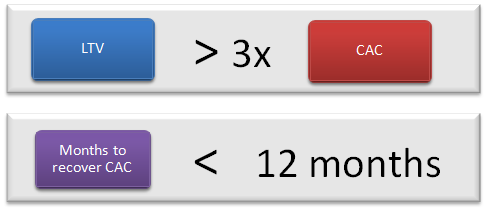

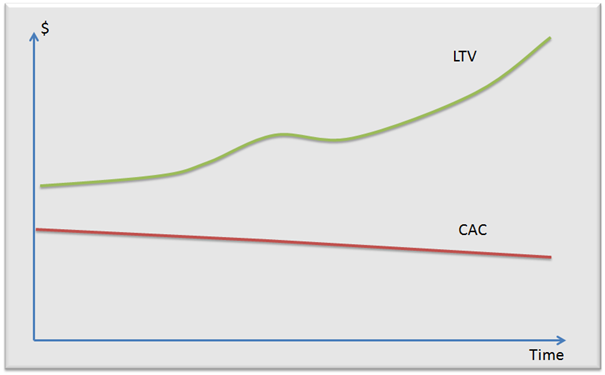

Is your SaaS business viable?

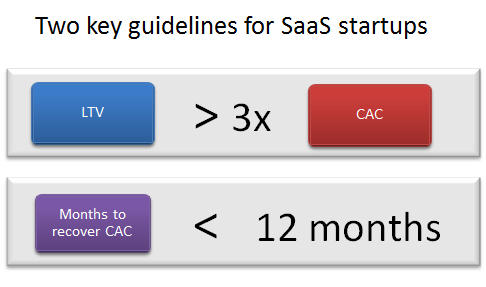

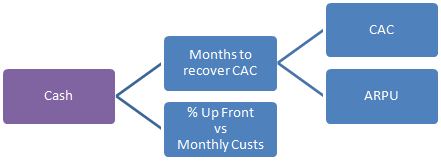

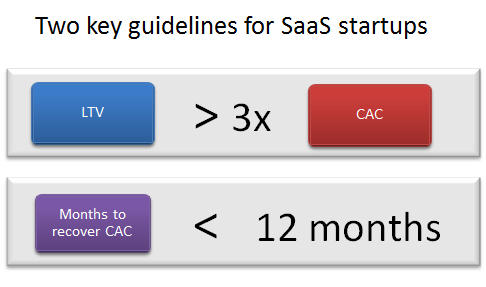

In the first version of this article, I introduced two guidelines

that could be used to judge quickly whether your SaaS business is

viable. The first is a good way to figure out if you will be profitable

in the long run, and the second is about measuring the time to

profitability (which also greatly impacts capital efficiency).

Over the last two years, I have had the chance to validate these

guidelines with many SaaS businesses, and it turns out that these early

guesses have held up well. The best SaaS businesses have a LTV to CAC

ratio that is higher than 3, sometimes as high as 7 or 8. And many of

the best SaaS businesses are able to recover their CAC in 5-7 months.

However many healthy SaaS businesses don’t meet the guidelines in the

early days, but can see how they can improve the business over time to

get there.

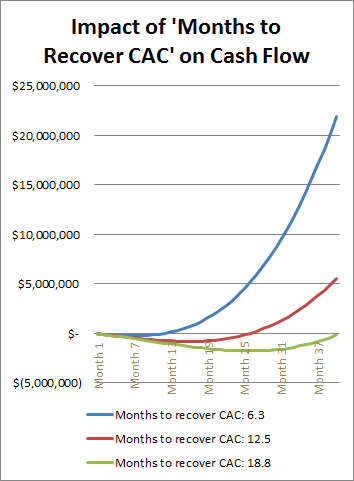

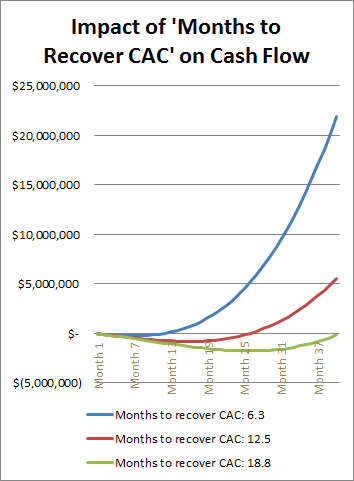

The second guideline (Months to Recover CAC) is all about time to

profitability and cash flow. Larger businesses, such as wireless

carriers and credit card companies, can afford to have a longer time to

recover CAC, as they have access to tons of cheap capital. Startups, on

the other hand, typically find that capital is expensive in the early

days. However even if capital is cheap, it turns out that Months to

recover CAC is a very good predictor of how well a SaaS business will

perform. Take a look at the graph below, which comes from the same model

used earlier. It shows how the profitability is anemic if the time to

recover CAC extends beyond 12 months.

I should stress that these are only guidelines, there are always situations where it makes sense to break them.

Three uses for the SaaS Guidelines

- One of the key jobs of the CEO is to decide when to hit the

accelerator pedal. The value of these two guidelines is that they help

you understand when you have a SaaS business that is in good shape,

where it makes sense to hit the accelerator pedal. Alternatively if your

business doesn’t meet the guidelines, it is a good indicator that there

is more tweaking needed to fix the business before you should expand.

- Another way to use the two guidelines is for evaluating different

lead sources. Different lead sources (e.g. Google AdWords, TV, Radio,

etc.) have different costs associated with them. The guidelines help you

understand if some of the more expensive lead generation options make

financial sense. If they meet these guidelines, it makes sense to hit

the accelerator on those sources (assuming you have the cash).Using the

second guideline, and working backwards, we can tell that if we are

getting paid $500 per month, we can afford to spend up to 12x that

amount (i.e. $6,000) on acquiring the customer. If we’re spending less

than that, you can afford to be more aggressive and spend more in

marketing or sales.

- There is another important way to use this type of guideline:

segmentation. Early-stage companies are often testing their offering

with several different uses/types of customers / pricing models /

industry verticals. It is very useful to examine which segments show the

quickest return or highest LTV to CAC in order to understand which will

be the most profitable to pursue.

Unit Economics in Action: HubSpot Example

HubSpot’s unit economics were recently published in an article in Forbes:

You can see from the second row in this table how they have

dramatically improved their unit economics (LTV:CAC ratio) over the five

quarters shown. The big driver for this was lowering the MRR Churn rate

from 3.5% to 1.5%. This drove up the lifetime value of the customer

considerably. They were also able to drive up their AVG MRR per

customer.

Brad Coffey, HubSpot:

In 2011 and early 2012 we used this chart to guide many of our

business decisions at HubSpot. By breaking LTV:CAC down into its

components we could examine each metric and understand what levers we

could pull to drive overall improvement.

It turned out that the levers we could pull varied by segment. In

the SMB market for instance we had the right sales process in place –

but had an opportunity to improve LTV by improving the product to lower

churn and increasing our average price in the segment. In the VSB (Very

Small Business) segment, by contrast, there wasn’t as much upside left

on the LTV (VSB customers have less money and naturally higher churn) so

we focused on lowering CAC by removing friction from our sales process

and moving more of our sales to the channel.

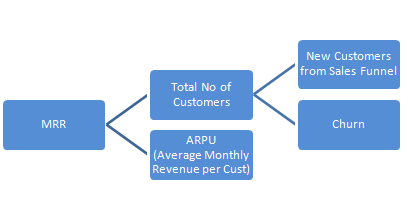

Two kinds of SaaS business:

There are two kinds of SaaS business:

- Those with primarily monthly contracts, with some longer term contracts. In this business, the primary focus will be on MRR (Monthly Recurring Revenue)

- Those with primarily annual contracts, with some contracts for multiple years. Here the primary focus is on ARR (Annual Recurring Revenue), and ACV (Annual Contract Value).

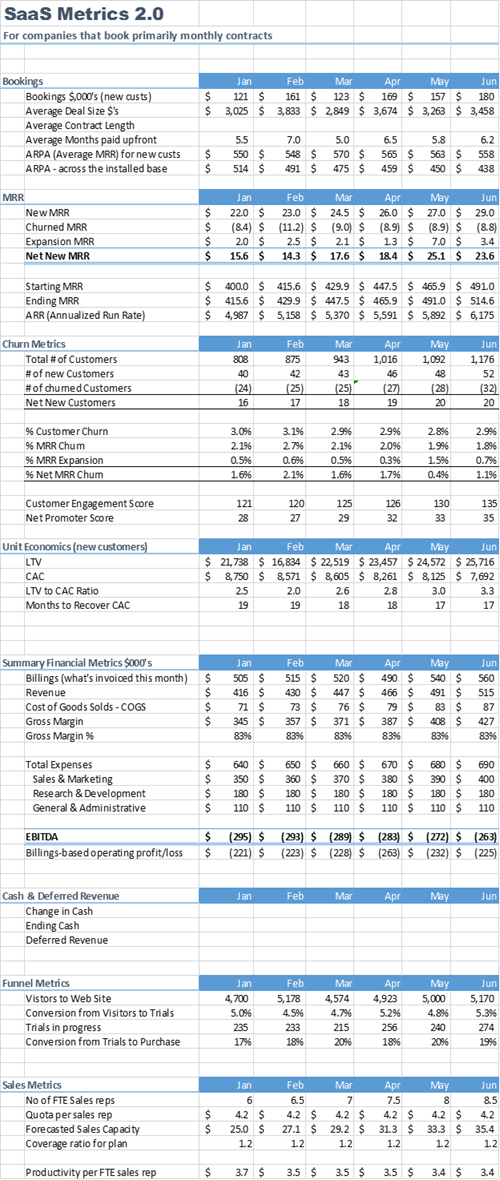

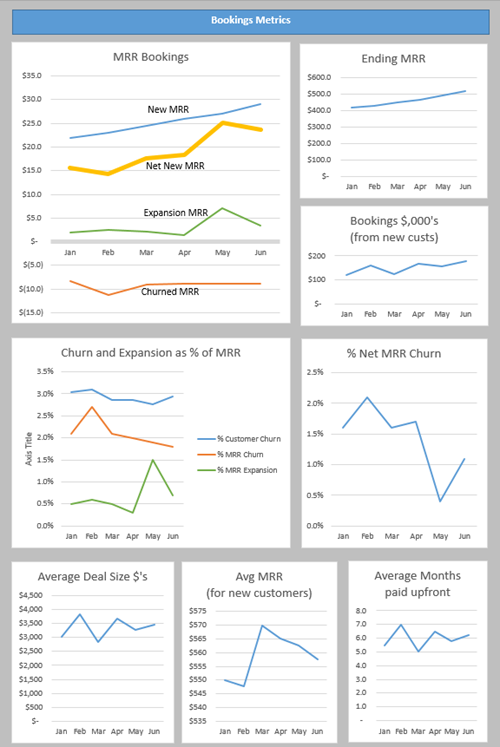

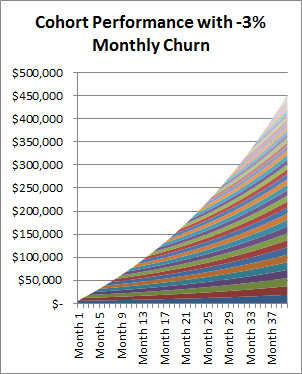

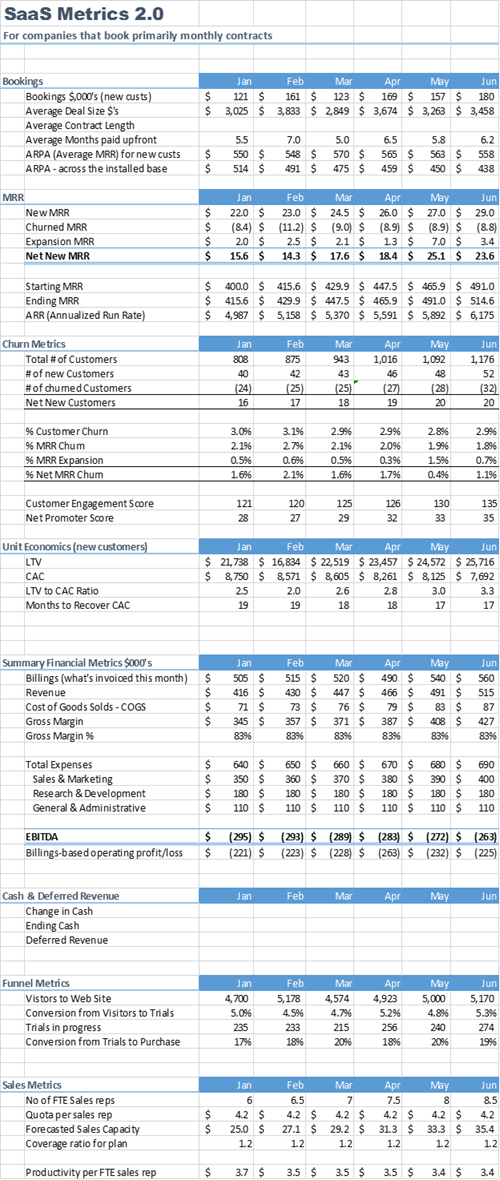

Most of the time in this article, I will refer to MRR/ACV. This means

use MRR if you are the first kind of business, or ACV if you are the

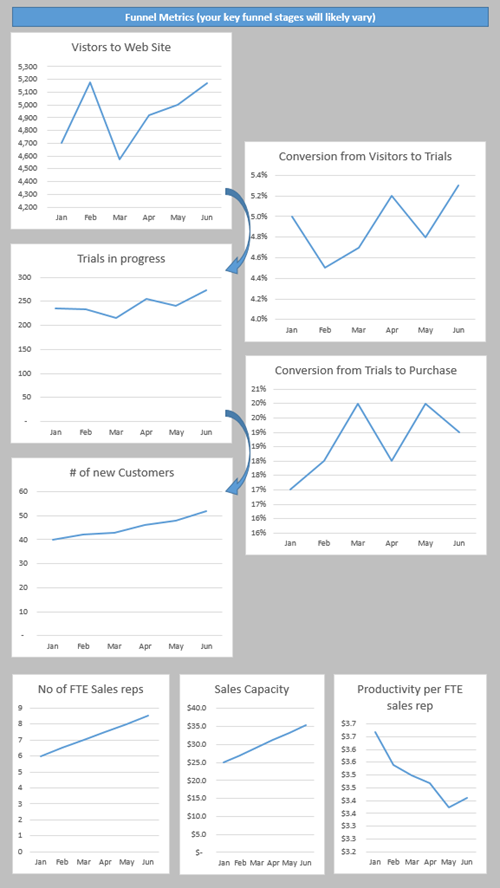

second kind of business. The dashboard shown below assumes monthly

contracts (MRR). However in the downloadable spreadsheet, there is a tab that shows the same dashboard for the second kind, focusing on ACV instead of MRR.

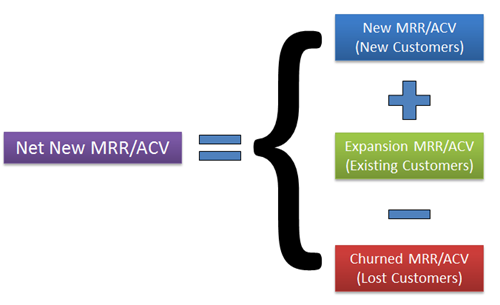

SaaS Bookings: Three Contributing Elements

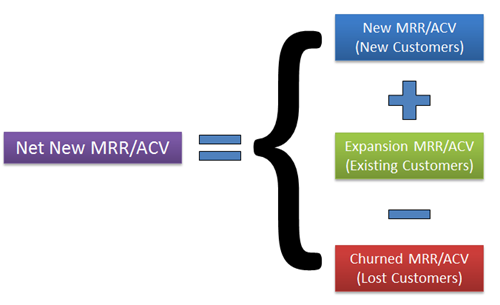

Every month in a SaaS business, there are three elements that

contribute to how much MRR will change relative to the previous month:

What happened with new customers added in the month:

What happened in the installed base of customers:

- Churned MRR (or ACV) (from existing customers that cancelled their subscription. This will be a negative number.)

- Expansion MRR (or ACV) (from existing customers who expanded their subscription)

The sum all three of these makes up your Net MRR or ACV Bookings:

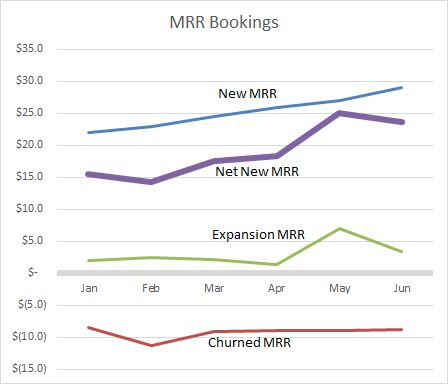

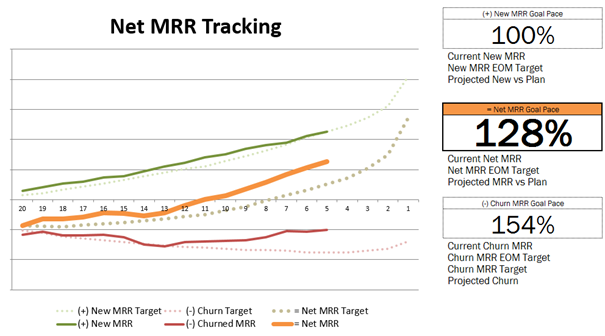

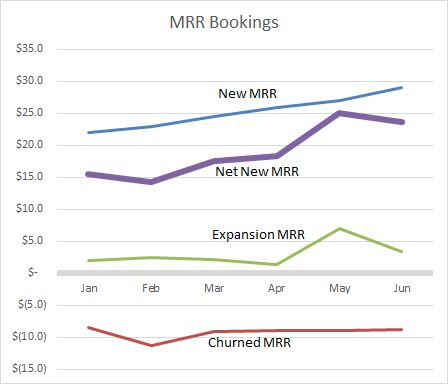

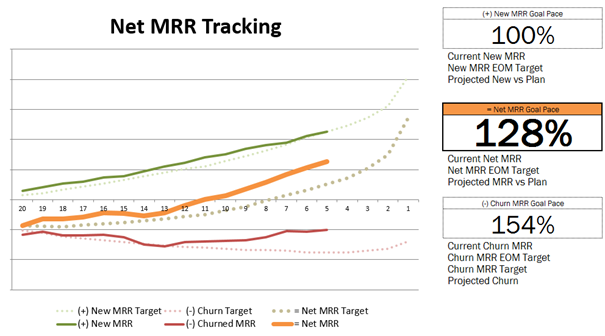

I recommend that you track these using a chart similar to the one below:

This chart shows the three components of MRR (or ACV) Bookings, and

the Net New MRR (or ACV) Bookings. By breaking out each component, you

can track the key elements that are driving your business. The one

variation we would recommend making to this chart is to show a dotted

line for the plan, so you can track how you are doing against plan for

each of the four lines. This is one of the most important charts to help

you understand and run your business.

Ron Gill, NetSuite:

This chart is really good. I also like to look at this data in

tabular form because I want to know y-o-y growth rates. E.g. “Net new

MRR is up 25% over June of last year”. The Y-o-Y % is a metric easily

compared with increased spending, sales capacity, etc.

The Importance of Customer Retention (Churn)

In the early days of a SaaS business, churn really doesn’t matter

that much. Let’s say that you lose 3% of your customers every month.

When you only have a hundred customers, losing 3 of them is not that

terrible. You can easily go and find another 3 to replace them. However

as your business grows in size, the problem becomes different. Imagine

that you have become really big, and now have a million customers. 3%

churn means that you are losing 30,000 customers every month! That turns

out to be a much harder number to replace. Companies like Constant

Contact have run into this problem, and it has made it very hard for

them to keep up their growth rate.

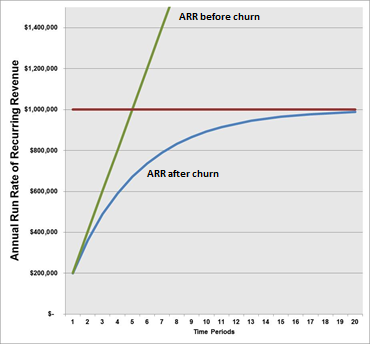

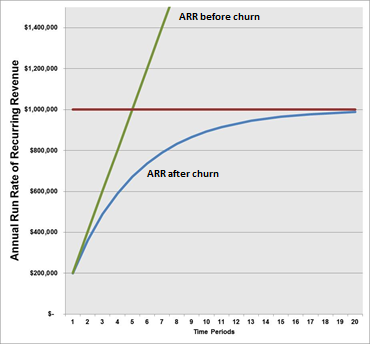

Ron Gill, NetSuite:

One oft-overlooked aspect of churn is that the churn rate,

combined with the rate of new ARR adds, not only defines how fast you

can grow the business, it also defines the maximum size the business can reach (see graph below).

It is an enlightening exercise to build a simple model like this

for your business and plot where your current revenue run rate sits on

the blue line defined by your present rate of ARR adds and churn. Are

you near the left-hand side, where the growth is still steep and the

ceiling is still far above? Or, are you further to the right where

revenue growth will level off and there is limited room left to grow?

How much benefit will you get from small improvements in churn or the

pace of new business sign-up?

At NetSuite, we’ve had great success shifting the line in the

last few years by both dramatically decreasing churn and by increasing

average deal size and volume, thus increasing ARR adds. The result was

both to steadily move the limit upward and to steepen the growth curve

at the current ARR run rate, creating room for increasingly rapid

expansion.

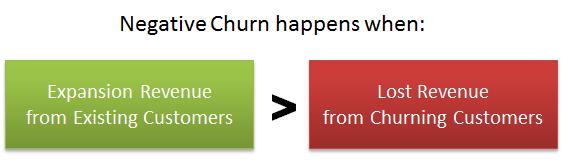

The Power of Negative Churn

The ultimate solution to the churn problem is to get to Negative Churn.

There are two ways to get this expansion revenue:

- Use a pricing scheme that has a variable axis, such as the number of

seats used, the number of leads tracked, etc. That way, as your

customers expand their usage of your product, they pay you more.

- Upsell/Cross-sell them to more powerful versions of your product, or additional modules.

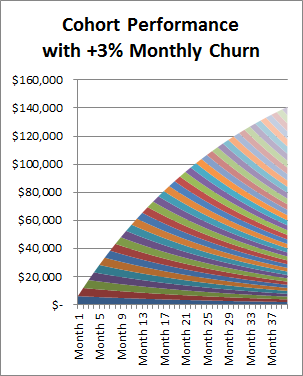

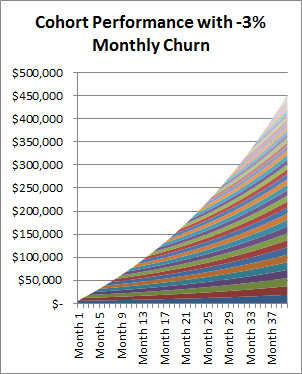

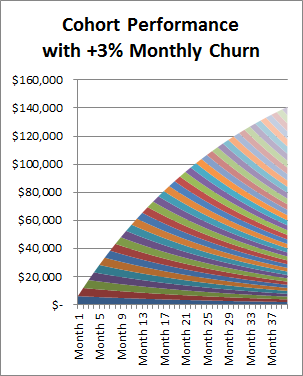

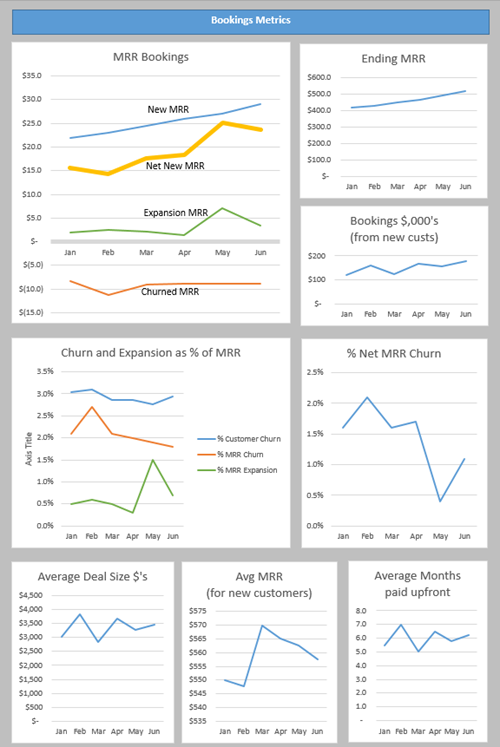

To help illustrate the power of negative churn, take a look at the

following two graphs that show how cohorts behave with 3% churn, and

then with 3% negative churn. (Since this is the first time I have used

the word Cohort, let me explain what it means. A cohort is simply a

fancy word for a group of customers. In the SaaS world, it is used

typically to describe the group that joined in a particular month. So

there would be the January cohort, February cohort, etc. In our graphs

below, a different color is used for each month’s cohort, so we can see

how they decline or grow, based on the churn rate.)

In the top graph, we are losing 3% of our revenue every month, and

you can see that with a constant bookings rate of $6k per month, the

revenue reaches $140k after 40 months, and growth is flattening out. In

the bottom graph, we may be losing some customers, but the remaining

customers are more than making up for that with increased revenue. With a

negative churn rate of 3%, we reach $450k in revenue (more then 3x

greater), and the growth in revenues is increasing, not flattening.

For more on this topic, you may wish to refer to these two blog posts of mine:

Defining a Dashboard for a SaaS Company

The following section should be most useful for readers who are

interested putting together a dashboard to help them manage their SaaS

business. To this, we created an excel file

for an imaginary SaaS company, and laid out a traditional numeric

report on one tab, and then a dashboard of graphs on a second tab (see

below). These represent one view on how to do this. You may have a very

different approach. But hopefully this will give you some ideas. I

would recommend adding a dotted line with the plan number to all

graphs. This will allow you to quickly see how you are doing versus

plan.

There are two versions of the Dashboard: the one shown below, which

is designed for companies using primarily monthly contracts (focused on

MRR). And a second version that can be found here which is designed for companies using annual contracts, focusing on ACV (Annual Contract Value).

Brad Coffey, HubSpot:

At HubSpot we obsess over these metrics – and watch many of them

every day. Each night we send out a ‘waterfall’ chart that tracks our

progress against our typical progress given the number of business days

left in the month. Here is an example of what we look at to ensure we’re

on track to meet our net MRR goals.

By looking at this daily we can take action immediately if we’re

tracking towards a bad month or quarter. Things like services promotion

(for churned MRR) or sales contests & promotions (for new &

expansion MRR) are adjustments we make within a given month in order to

nail our goals. (In this model we combine expansion and churned MRR into

one churned MRR line).

Detailed definitions of the various metrics used

Detailed definitions for each of the various metrics used can be found in this reference document:

Revenue Churn vs Customer Churn – why are they different?

You might be wondering why it’s necessary to track both Customer

Churn and Revenue Churn. Imagine a scenario where we have 50 small

accounts paying us $100 a month, and 50 large accounts paying us $1,000 a

month. In total we have 100 customers, and an MRR of $55,000 at the

start of the month. Now imagine that we lose 10 of them. Our Customer

churn rate is 10%. But if out of the ten churned customers, 9 of them

were small accounts, and only one was a large account. We would only

have lost $1,900 in MRR. That represents only 3.4% Revenue Churn. So you

can see that the two numbers can be quite different. But each is

important to understand if we want a complete picture of what is going

on in the business.

Getting paid in advance

Getting paid in advance is really smart idea if you can do it without

impacting bookings, as it can provide the cash flow that you need to

cover the cash problem that we described earlier in the article. It is

often worth providing good financial incentives in the form of discounts

to encourage this behavior. The metric that we use to track how well

your sales force is doing in this area is Months up Front.

Getting paid more upfront usually also helps lower churn. This

happens because the customer has made a greater commitment to your

service, and is more likely to spend the time getting it up and running.

You also have more time to overcome issues that might arise with the

implementation in the early days. Calculating LTV and CAC

The Metric “Months up Front” has been used at both HubSpot and

NetSuite in the past as a way to incent sales people to get more paid up

front when a new customer is signed. However asking for more money up

front may turn off certain customers, and result in fewer new customers,

so be careful how you balance these two conflicting goals.

Calculating CAC and LTV

Detailed information on how to calculate LTV and CAC is provided in the supplemental document that can be accessed by clicking here.

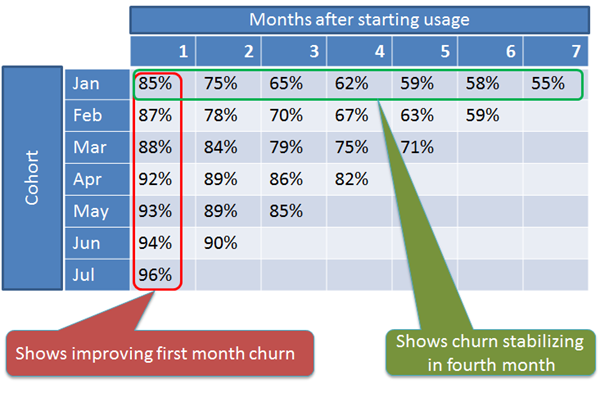

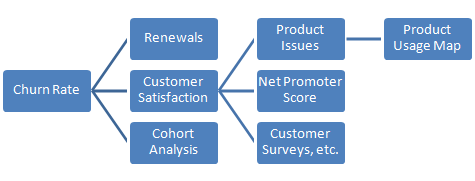

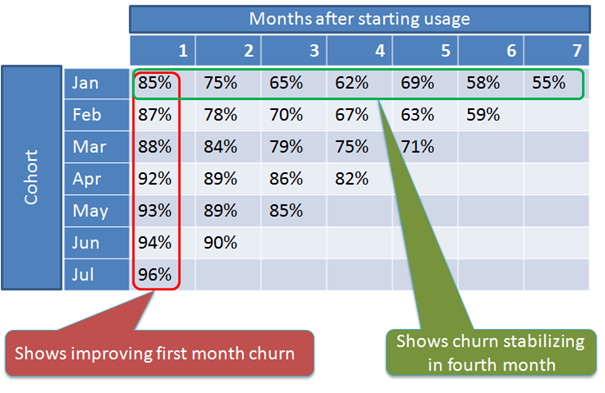

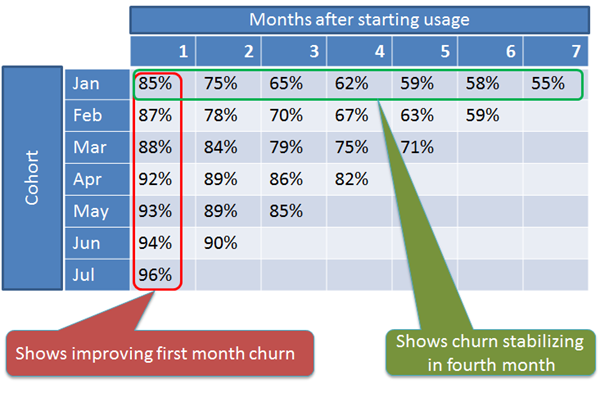

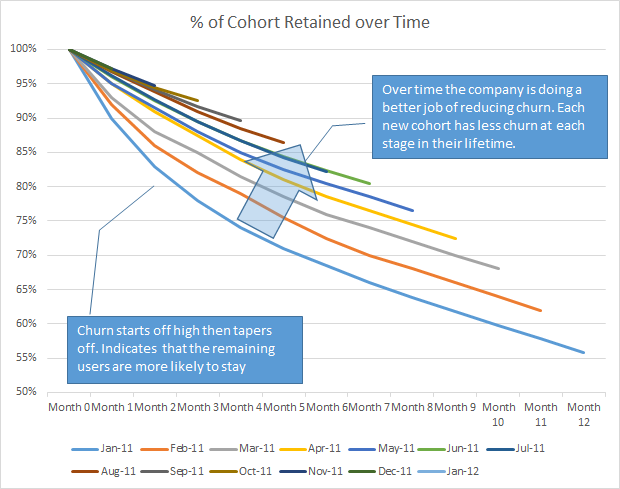

More on Churn: Cohort Analysis

Since churn is such a critical element for success in a SaaS company,

it is an area that requires deeper exploration to understand. Cohort

Analysis is one of the important techniques that we use to gain insight.

As mentioned earlier, a cohort is simply a fancy name for a group. In

SaaS businesses, we use cohort analysis to observe what happens to the

group of customers that joined in a particular month. So we we will

have a January cohort, a February cohort, etc. We would then be able to

observe how our January cohort behaves over time (see illustration

below).

This can help answer questions such as:

- Are we losing most of the customers in the first couple of months?

- Does Churn stabilize after some period of time?

Then if took some actions to try to fix churn in early months, (i.e

with better product features, easier on-boarding, better training, etc.)

we would want to know if those changes had been successful. The cohort

analysis allows us to do this by comparing how more recent cohorts (e.g.

July in the table above) compared against January. The table above

shows that we made a big improvement in the first month churn going from

15% to 4%.

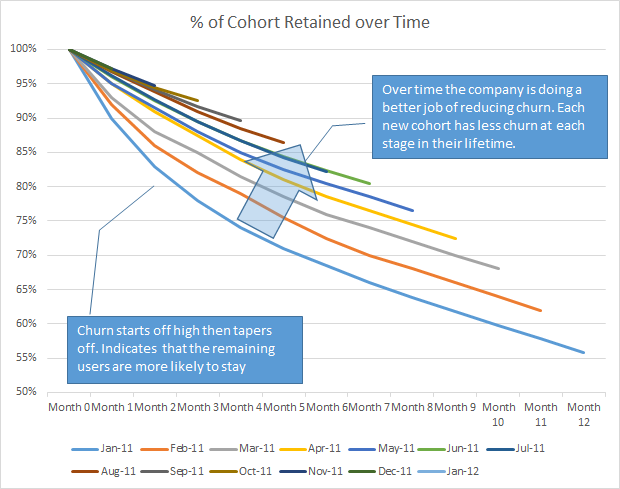

Two ways to run Cohort Analysis

There are two ways to run Cohort Analysis: the first looks at the

number of customers, and the second looks at the Revenue. Each teaches

us something different and valuable. The example graph below simply

looks at the number of customers in each cohort over time:

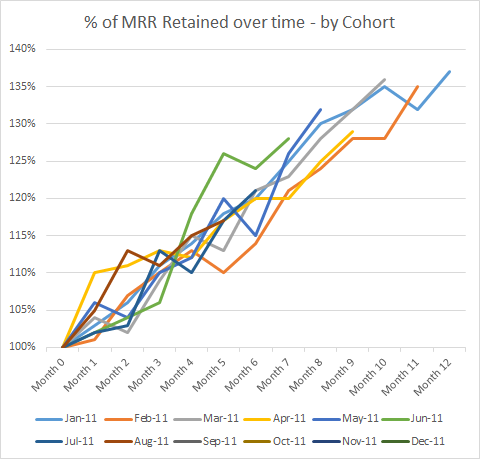

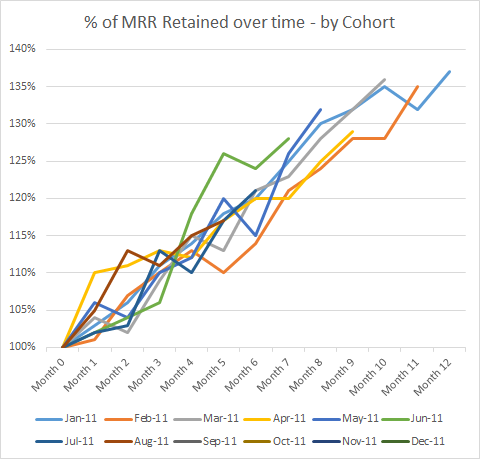

The example graph below looks at how MRR evolves over time for each

cohort. This particular example illustrates how the graph would look if

there is very strong negative churn. As you can see, the increase in

revenue from the customers that are still using the service is easily

outpacing the lost revenue from churned customers. It is pretty rare to

see things look this good, but it is the ideal situation that we are

looking for. For those wondering if this can be achieved, one company in

our portfolio, Zendesk, that has numbers that are even better than

those shown in the example below.

In the situation above, you will need a more complex formula to

calculate LTV, as the value of the average customer is increasing over

time. For more on that topic, you may want to check out the accompanying definitions document.

Predicting Churn: Customer Engagement Score

Since churn is so important, wouldn’t it be useful if we could

predict in advance which customers were most likely to churn? That way

we could put our best customer service reps to work in an effort to save

the situation. It turns out that we can do that by instrumenting our

SaaS applications and tracking whether our users are engaged with the

key sticky features of the product. Different features will deserve

different scores. For example if you were Facebook, you might score

someone who uploaded a picture as far more engaged (and therefore less

likely to churn), than someone who simply logged in and viewed one page.

Similarly if you sold your SaaS product to a 100 person department,

and only 10 people were using it, you would score that differently to 90

people using it. So the recommendation is that you create a Customer

Engagement Score, based on allocating points for the particular features

used. Allocate more points for the features you believe are most

sticky. (Later on you can go back and look at the customers who actually

churned, and validate that you picked the right features as a predictor

of who would churn.) And separately score how many users are engaged

with specific scores.

Over time you’ll also come to discover which types of use are the

best indicators of possible upsell. (HubSpot was the first company that I

worked with who figured this out, and they called it their CHI score.

CHI stands for Customer Happiness Index. It evolved to be a very good

predictor for churn.)

Brad Coffey, HubSpot:

At HubSpot we had a lot of success looking at this metric – we

called in Customer Happiness Index (CHI). First – by running the

analysis we identified the parts of our application that provide the

most value to customers and could invest accordingly in driving adoption

in those areas. Second – we used this aggregate score as an early proxy

for success as we experimented with different sales and onboarding

processes. If a set of customers going through an experiment had a low

CHI score we could kill the project without waiting 6 or 12 months to

analyze the cohort retention.

NPS – Net Promoter Score

Since it is likely that customer satisfaction is likely to be good

predictor of future churn, it would be useful to survey customer

satisfaction. The recommended way to measure customer happiness is to

use Net Promoter Score (NPS). The beauty of NPS is that it is a

standardized number, so you can compare your company to others. For

more details on Net Promoter Score, click here.

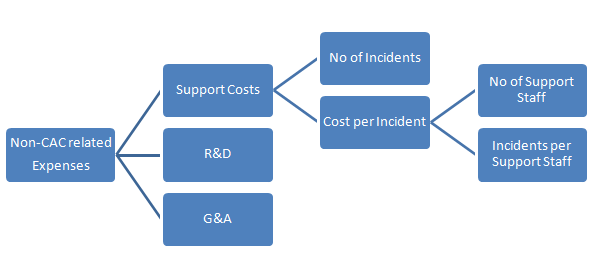

Guidelines for Churn

If your Net Revenue Churn is high (above 2% per month) it is an

indicator that there is something wrong in your business. At 2% monthly

churn, you are losing about 22% of your revenue every year. That is

nearly a quarter of your revenue! It’s a clear indication that there is

something wrong with the business. As the business gets bigger, this

will become a major drag on growth.

We recommend that you work on fixing the problems that are causing

this before you go on to worry about other parts of your business. Some

of the possible causes of churn are:

- You are not meeting your customers expectations.

- The product may not provide enough value

- Instability or bugginess

- Your product is not sticky. It might provide some value in the first

few months, and then once the customer has that value, they may feel

they don’t need to keep paying. To make your product sticky, try making

it a key part of their monthly workflow, and/or have them store data in

your product that is highly valuable to them, where the value would be

lost of they cancelled.

- You have not successfully got the customer’s users to adopt the

product. Or they may not be using certain of the key sticky features in

the product.

- Your sales force may have oversold the product, or sold it to a customer that is not well suited to get the benefits

- You may be selling to SMB’s where a lot of them go out of business. It isn’t enough that what you’re selling is sticky. Who you’re selling it to must also be sticky.

- You are not using a pricing scheme that helps drive expansion bookings

The best way to find out why customers are churning is to get on the

phone with them and ask them. If churn is a significant part of your

business, we recommend that the founders themselves make these calls.

They need to hear first hand what the problem is, as this is so

important for the success of the business. And they are likely to be the

best people to design a fix for the problem.

The Importance of Customer Segmentation

In all SaaS businesses there will likely come a moment where they

realize that not all customers are created equal. As an example, bigger

customers are harder to sell to, but usually place bigger orders, and

churn less frequently. We need a way to understand which of these are

most profitable, and this requires us to segment the customer base into

different types, and compute the unit economics metrics for each segment

separately. Common segments are things size of of customer, vertical

industry, etc.

Despite the added work to produce the metrics, there is high value in

understanding the different segments. This tells us which parts of the

business are working well, and which are not. In addition to knowing

where to focus and invest resources, we may recognize the need for

different marketing messages, product features. As soon as you start

doing this segmented analysis, the benefits will become immediately

apparent.

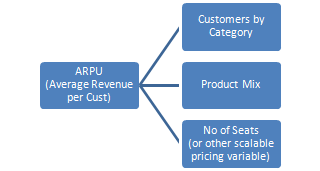

For each segment, we recommend tracking the following metrics:

- ARPA (Average Revenue per Account per month)

- Net MRR Churn rate (including MRR expansion)

- LTV

- CAC

- LTV: CAC ratio

- Months to recover CAC

- Customer Engagement Score

Brad Coffey, HubSpot:

At HubSpot, we started to see some of our biggest improvements in

unit economics when we started segmenting our business and calculating

the LTV to CAC ratio for each of our personas and go to market

strategies.

As one good example – when we started this analysis, we had 12

reps selling directly into the VSB market and 4 reps selling through

Value Added Resellers (VARs). When we looked at the math we realized we

had a LTV:CAC ratio of 1.5 selling direct, and a LTV:CAC ratio of 5

selling through the channel. The solution was obvious. Twelve months

later we had flipped our approach – keeping just 2 reps selling direct

and 25 reps selling through the channel. This dramatically improved our

overall economics in the segment and allowed us to continue growing.

We ended making similar investments in other high LTV:CAC

segments. We went so far as to incentivize our sales managers to grow

their teams – but then would only place new sales hires into the

segments with the best economics. This ensured we continued to invest in

the best segments and aligned incentives throughout the company on our

LTV:CAC goals. It also allowed us to push innovation down to the sales

manager level. Managers could experiment with org structure, and sales

processes – but they knew that if they didn’t hit their LTV:CAC goals

they wouldn’t be able to grow their teams.

Calculating LTV:CAC by segment can be challenging, especially on

the CAC side. It’s relatively easy at the top level to add up all the

marketing and sales expense in a period and divide it by the total

number of customers (to get CAC). Once you try to segment down your

spend you run into questions like ‘how much marketing expense do I

allocate to a given segment’, ‘how much of the sales expense’?

We solved this by allocating marketing expense based on number of

leads and sales expense based on headcount but it’s not perfect. For us

the keys are: 1) Needs to account for all costs – no free lunch, 2) It

needs to be consistent over time. Progress on improving the metric is

more important than the actual value.

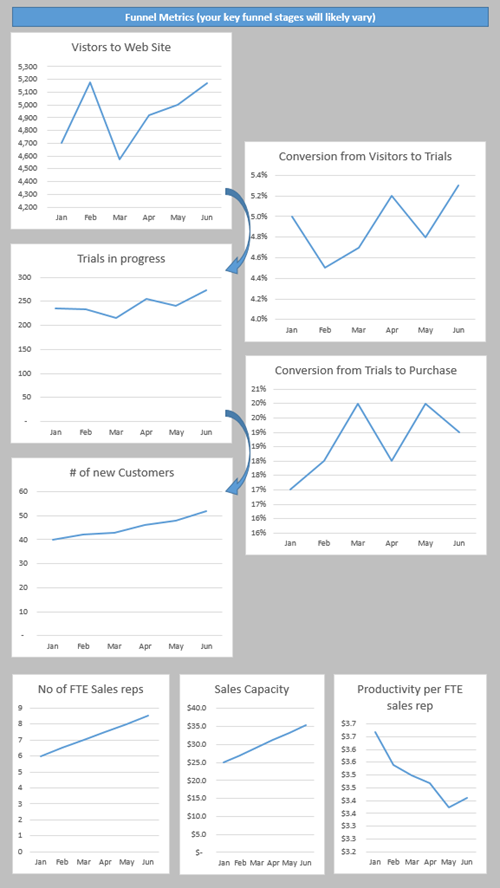

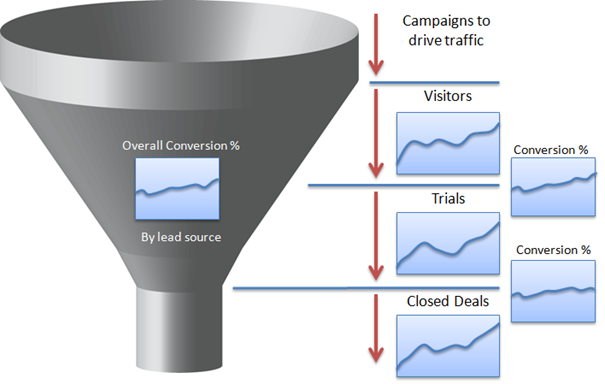

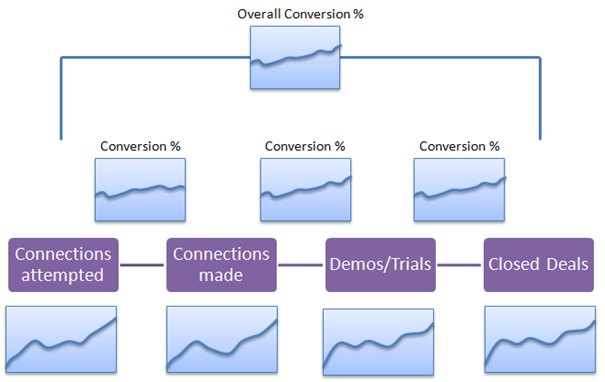

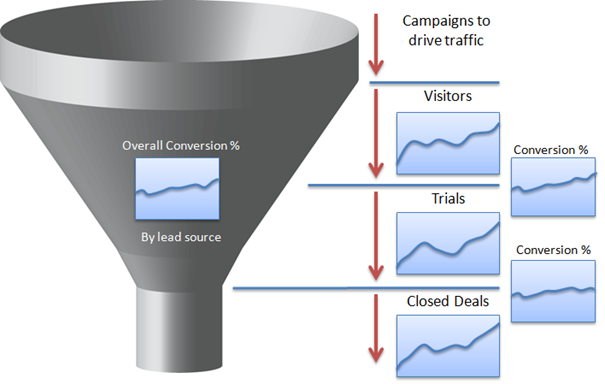

Funnel Metrics

The metrics that matter for each sales funnel, vary from one company

to the next depending on the steps involved in the funnel. However there

is a common way to measure each step, and the overall funnel,

regardless of your sales process. That involves measuring two things for

each step: the number of leads that went into the top of that step,

and the conversion rate to the next step in the funnel (see below).

In the diagram above, (mirrored in the dashboard), we show a very

simple three phase sales process, with visitors coming to a web site,

and some portion of them signing up for a trial. Then some of the trials

convert to purchases. As you can see in the dashboard, we will want to

track the number of visitors, trials and closed deals. Our goal should

be to increase those numbers over time. And we will also want to track

the conversion rates, with the goal of improving those over time.

Using Funnel Metrics in Forward Planning

Another key value of having these conversion rates is the ability to

understand the implications of future forecasts. For example, lets say

your company wants to do $4m in the next quarter. You can work backwards

to figure out how many demos/trials that means, and given the sales

productivity numbers – how many salespeople are required, and going back

a stage earlier, how many leads are going to be required. These are

crucial planning numbers that can change staffing levels, marketing

program spend levels, etc.

Sales Capacity

In many SaaS businesses, sales reps play a key role in closing deals.

In those situations, the number of productive sales people (Sales

Capacity) will be a key driver of bookings. It is important to work

backwards from any forecasts that are made, to ensure that there is

enough sales capacity. I’ve seen many businesses miss their targets because they failed to hire enough productive salespeople early enough.

It’s also worth noting that some percentage of new sales hires won’t

meet expectations, so that should be taken into consideration when

setting hiring goals. Typically we have seen failure rates around 25-30%

for field sales reps, but this varies by company. The failure rate is

lower for inside sales reps.

When computing Sales Capacity, if a newer rep is still ramping and

only expected to deliver 50% of quota, they can be counted as half of a

productive rep. That is often referred to as Full Time Equivalent or FTE

for short.

Another important metric to understand is the number of leads

required to feed a sales rep. If you are adding sales reps, make sure

you also have a clear plan of how you will drive the additional leads

required.

There is much more that could be said on this topic, but since it is

all very similar to managing a sales force in a traditional software

company, we will leave that for other blog posts.

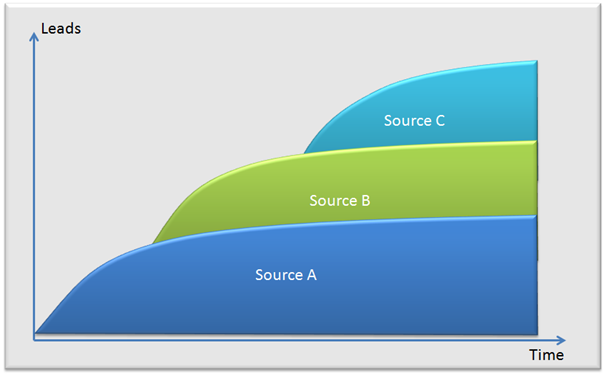

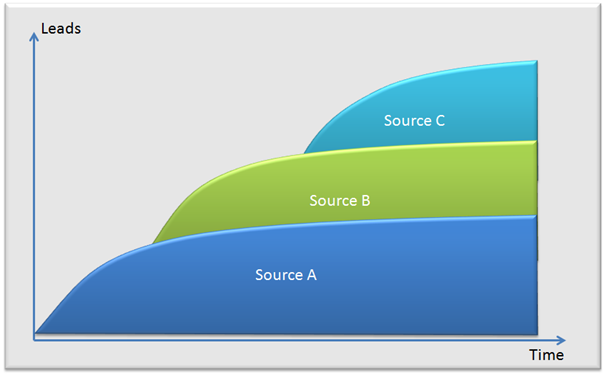

Understanding the ROI for different Lead Sources

Our experiences with SaaS startups indicate that they usually start

with a couple of lead generation programs such as Pay Per Click Google

Ad-words, radio ads, etc. What we have found is that each of these lead

sources tends to saturate over time, and produce less leads for more

dollars invested. As a result, SaaS companies will need to be constantly

evaluating new lead sources that they can layer in on top of the old to

keep growing.

Since the conversion rates and costs per lead vary quite

considerably, it is important to also measure the overall ROI by lead

source.

Growing leads fast enough to feed the front end of the funnel is one

of the perennial challenges for any SaaS company, and is likely to be

one of the greatest limiting factors to growth. If you are facing that

situation, the most powerful advice we can give you is to start

investing in Inbound Marketing techniques (see Get Found using Inbound Marketing).

This will take time to ramp up, but if you can do it well, will lead to

far lower lead costs, and greater scaling than other paid techniques.

Additionally the typical SaaS buyer is clearly web-savvy, and therefore

very likely to embrace inbound marketing content and touchless selling

techniques.

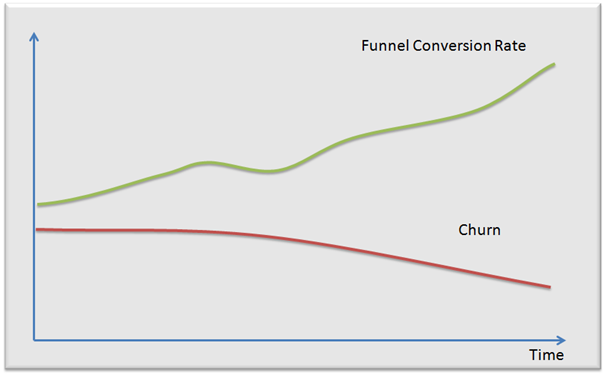

What Levers are available to drive Growth

SaaS businesses are more numerically driven than most other kinds of

business. Making a small tweak to a number like the churn rate can have a

very big impact on the overall health of the business. Because of this

we frequently see a “quant” (i.e. a numbers oriented, spreadsheet

modeling, type of person) as a valuable hire in a SaaS business. At

HubSpot, Brad Coffey played that role, and he was able to run the models

to determine which growth plays made the most sense.

Understanding these SaaS metrics is a key step towards seeing how you

can drive your business going forward. Let’s look at some of the levers

that these imply as growth drivers for your business:

Churn

- Get Churn and customer happiness right first (if this isn’t right,

the business isn’t viable, so no point in driving growth elsewhere. You

will simply be filling a leaky bucket.)

Product

- You’re in a product business – first and foremost: fix your product.

- If you’re using a free trial, focus on getting the conversion rate

for that right (ideally around 15 – 20%). If this isn’t right, your

value proposition isn’t resonating, or you may have a market where there

is not enough pain to get people to buy.

- Win/Loss ratio should be good

- Trial or Sales conversion rates on qualified leads should be good

Funnel metrics

- Increase the number of raw leads coming in to the Top of your funnel

- Identify the profitable lead sources and invest in those as much as

possible. Conversely stop investing in poor lead sources until they can

be tweaked to make them profitable.

- Increase the Conversion Rates at various stages in the funnel

Sales Metrics

- Sales productivity (focus on getting this right consistently across a broad set of sales folks before hitting the gas)

- Add Sales Capacity. But first make sure you know how to provide them

with the right number of leads. This turns out to be one of the key

levers that many companies rely on for growth. We have learned from

experience how important it is to meet your targets for sales capacity

by hiring on time, and hiring the right quality of sales people so there are fewer failures.

- Increase retention for your sales people. Since you have invested a

lot in making them fully productive, get the maximum return on that

investment by keeping them longer.

- Look at adding Business Development Reps. These are outbound sales

folks who specialize in prospecting to a targeted list of potential

buyers. For more on this topic, click here.

Pricing/Upsell/Cross Sell

- Multi-axis pricing

- Additional product modules (easier to sell more to existing customers than it is to sell to brand new customers)

Brad Coffey, HubSpot:

Turns out the pricing your product right can have a huge impact on

the unit economics. Not simply by getting the average MRR right, or by

providing upsell opportunities – but also by signaling what pieces of

the product are most valuable.

At HubSpot we changed our pricing in 2011 to be tiered based on

the number of contacts in the system – and actually saw an increase in

adoption of the contacts application after we made the change. This is

counter-intuitive but makes sense given that we sell through an inside

sales team. After the pricing change, sales reps now could make a lot

more money by selling the contacts. And they quickly become much better

at positioning that part of the product, as well as finding companies

with a contacts-based use case. Product quality will remain paramount –

but it’s remarkable how much impact pricing, packaging and sales

commission structure can have on product adoption and unit economics.

Customer Segmentation

Customer Segmentation analysis will help point out which are your

most profitable segments. Two immediate actions that are suggested by

this analysis are:

- Double down on your most profitable segments

- Look at your less profitable segments and consider changes that

would make them more profitable: lower cost marketing & sales

approaches, higher pricing, product changes, etc. If nothing seems to

make sense, spend less effort on these segments.

International Markets

Expansion internationally is only recommended for fairly mature SaaS

companies that already have honed their business practices in their

primary market. It is far harder to experiment and tune a business in

far off regions, with language and cultural differences.

Brad Coffey, HubSpot

- One of the biggest challenges we face is the trade-off between

growth and unit economics (specifically churn). Many of the things that

we have done to reduce churn have (potentially) come at the expense of

lowering our growth rate. Those have been some of our hardest

decisions: e.g. requiring upfront payments, requiring customers buy

consulting, holding sales reps accountable for churn, etc. We are always

looking at things that give us growth without the tradeoff of lower

growth. For example product improvement is an obvious one – a better

product is easier to sell and provides more value to the customer.

Services promotions actually work well too. Many of the options that

SaaS companies have to adjust their business are not simply a win-win

but are still worth exploring. Too many companies think that every

problem is a product problem and every solution is that the product must

get better.

- The other thing that’s really important is that companies don’t

try to spin these numbers. There is so much pressure to dismiss a bad

customer (who hurt your churn number) or exclude costs (only count

marketing ‘program’ spend – not headcount). If you can get the

accounting close enough to right it actually frees management from

needing to make every decision. If the accounting is right management

can obsess over setting goals (growth, LTV:CAC), hold people accountable

to those goals and then give autonomy to their team on how to achieve

those goals.

Plan ahead

It takes time for most initiatives to have an impact. We’ve learned

from some tough lessons that planning has to be done well in advance to

drive a SaaS business. For example if you are not happy with your

current growth rate, it will often take nine to twelve months from the

point of decision before the growth resulting from increased investment

in sales and marketing will actually be observed.

The High Level Picture: How to Run a SaaS Business

Hopefully what you will have gathered from the discussion above is

that there are really three things that really matter when running a

SaaS business:

- Acquiring customers

- Retaining customers

- Monetizing your customers

The second item should be first on your list of things to get right.

If you can’t keep your customers happy, and keep them using the service,

there is no point in worrying acquiring more of them. You will simply

be filling a leaky bucket. Rather focus your attention on plugging the

leaks.

SaaS businesses are remarkably influenced by a few key numbers.

Making small improvements to those numbers can dramatically improve the

overall health of the business.

Once you know your SaaS business is viable using the guidelines

provided for LTV:CAC, and Time to recover CAC, hit the accelerator

pedal. But be prepared to raise the cash needed to fund the growth.

Although this article is long and occasionally complex, we hope that

it has helped provide you with an understanding of which metrics are

key, and how you can go about improving them.

Acknowledgements

I would like to thank Ron Gill, the CFO of NetSuite, and Brad Coffey

& Brian Halligan of Hubspot for their help in writing this. I would

like to thank the HubSpot management team without whom none of this

would be possible. Most of my learnings on SaaS have come from working

with them. I would also like to thank Gail Goodman, the CEO of Constant

Contact who also taught us many of the key metrics in her role as board

member of HubSpot.

David

Skok is a General Partner with Matrix

Partners. You can find this post, as well as

additional content on his blog called For Entrepreneurs. You can also follow David on Twitter (@BostonVC) by clicking here.