This blog post looks at the high level goals of a SaaS business and

drills down layer by layer to expose the key metrics that will help

drive success. Metrics for metric’s sake are not very useful. Instead

the goal is to provide a detailed look at what management must focus on

to drive a successful SaaS business. For each metric, we will also look

at what is actionable.

Before going any further, I would like to thank the management team

at HubSpot, and Gail Goodman of Constant Contact, who sits on the

HubSpot board. A huge part of the material that I write about below

comes my experiences working with them. In particular HubSpot’s

management team is comprised of a group of very bright individuals that

are all very metrics driven, and they have been clear thought leaders

in developing the appropriate tools to drive their business. I’d also

like to thank John Clancy, who until recently was President of Iron

Mountain Digital, a $230m SaaS business, and Alastair Mitchell, CEO and

founder of Huddle.

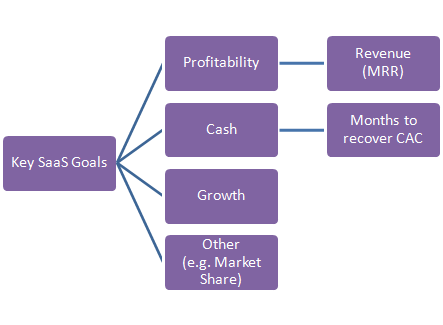

Let’s start by looking at the high level goals, and then drill down from there:

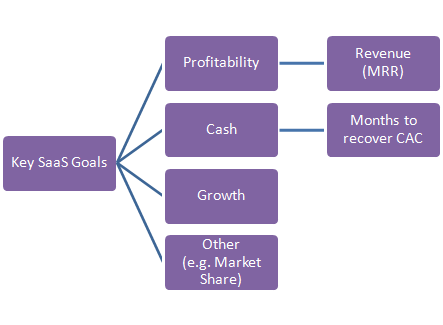

Key SaaS Goals

- Profitability: needs no further explanation.

- MRR Monthly Recurring Revenue: In a SaaS business, one of the most important numbers to watch is MRR. It is likely a key contributor to Profitability.

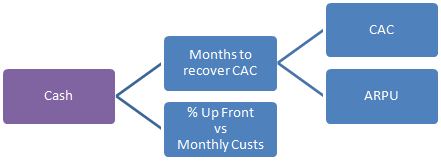

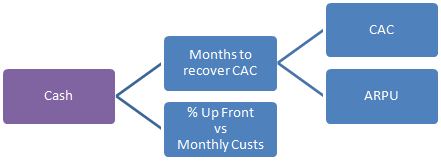

- Cash: very critical to watch in a SaaS business,

as there can be a high upfront cash outlay to acquire a customer, while

the cash payments from the customer come in small increments over a

long period of time. This problem can be somewhat alleviated by using

longer term contracts with advance payments.

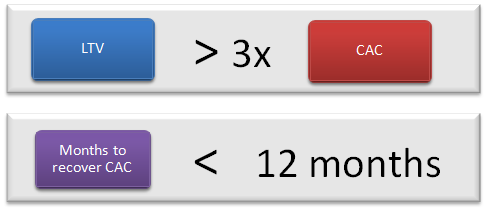

- Months to recover CAC: one of the best ways to

look at the capital efficiency of your SaaS business is to look at how

many months of revenue from a customer are required to recover your

cost of acquiring that customer(CAC). In businesses such as banking and

wireless carriers, where capital is cheap and abundant, they can afford

a long payback period before they recover their investment to acquire a

customer (typically greater than one year). In the startup world where

capital is scarce and expensive, you will need to do better. My own

rule says that startups need to recover their cost of customer

acquisition in less than 12 months.

(Note: there are other web

sites and blogs that talk about the CAC ratio, with a complex formula

to calculate it. This is effectively a more complicated way of saying

the same thing. However I have found that most people cannot relate

well to the notion of a CAC ratio, but they can easily relate to the

idea of how many months of revenue it will take to recover their

investment to acquire a customer. Hence my preference for the term

Months to Recover CAC.)

- Growth: usually a critical success factor to

gaining market leadership. There is clear evidence that once one

company starts to emerge as a market leader, there is a cycle of

positive reinforcement, as customers prefer to buy from the market

leader, and the market leader gets the most discussion in the press,

blogosphere, and social media.

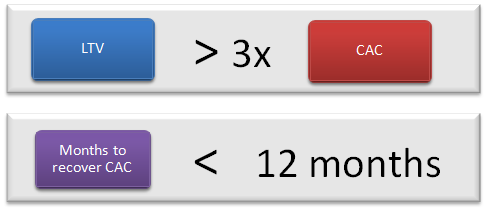

Two Key Guidelines for SaaS startups

The above guidelines are not hard and fast rules. They are what I

have observed to be needed by looking at a wide variety of SaaS

startups. As a business moves past the startup stage, these guidelines

may be relaxed.

In the next sections, we will drill down on the high level SaaS Goals to get to the components that drive each of these.

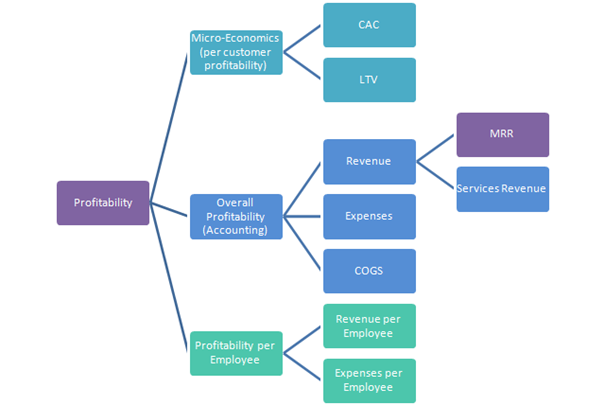

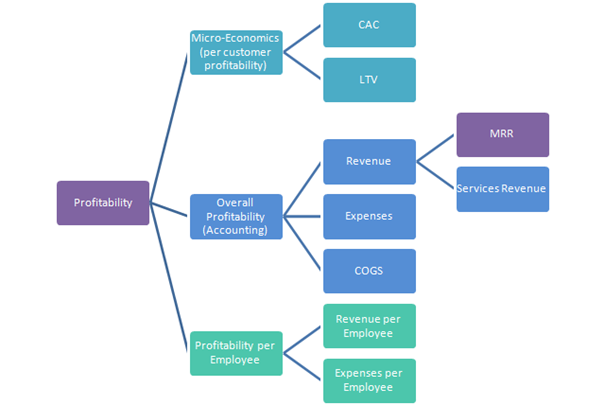

Three ways to look at Profitability

- Micro-Economics (per customer profitability):

Micro-economics is the term used to describe looking at the economics

of your business on a single customer level. Most business models (with

a few exceptions such as marketplaces) are based around a simple

principle: acquire customers and then monetize them. Micro-economics is

about measuring the numbers behind these two essential ingredients of a

customer interaction. The goal is to make sure the fundamental

underpinnings of your business are sound: how much it cost to acquire

your customers, and how much you can monetize them. i.e. CAC and LTV

(cost of acquiring a customer, and lifetime value of the customer). In

a SaaS business, you have a great business if LTV is significantly

greater than CAC. My rule of thumb is that LTV must be at least 3x

greater than CAC. (As mentioned elsewhere in this blog, your startup

will die if your long term number for CAC is higher than your LTV. See Startup Killer: The cost of acquiring customers.)

- Overall profitability (standard accounting method):

This looks a the standard accounting way of deriving profitability:

revenue – COGS – Expenses. The diagram also notes that Revenue is made

up of MRR + Services Revenue. Since MRR is such a critical element,

there will be a deeper drill down to understand the key component

drivers.

- Profitability per Employee: it can be useful to

look at the factors contributing to profitability on a per employee

basis, and benchmark your company against the rest of the industry.

Expenses per Employee is usually around $180-200k annually for

businesses with all their employees in the US. (To calculate the number

take the total of all expenses, not just salaraies, and divide by the

number of employees.) Clearly to be profitable in the long term, you

will want to see revenue per employee climb to be higher than expenses,

taking into account your gross margin %.

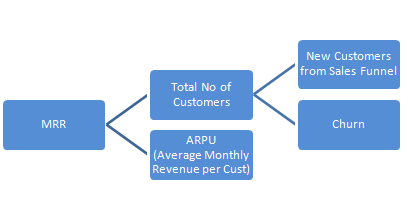

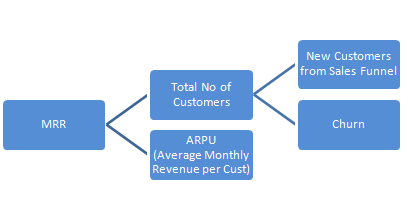

Drill down on MRR

MRR is computed by multiplying the total number of paying customers by the average amount that they pay you each month (ARPU).

- Total Customers: a key metric for any SaaS

company. This increases with new additions coming out the bottom of the

sales funnel, and decreases by the number of customers that churn. Both

of these are key metrics, and we will drill down into them later.

- ARPU – average monthly revenue per customer: (The

term ARPU comes from the wireless carriers where U stands for user.)

This is another extremely imporant variable that can be tweaked in the

SaaS model. If you read my blog post on the JBoss story,

you will see that one of the key ways that we grew that business was to

take the average annual deal size from $10k, to $50k. Given that the

other parts of the pipeline worked with the same numbers and conversion

rates, this grew the business by 5x. We will drill down into how you

can do the same thing a little further on.

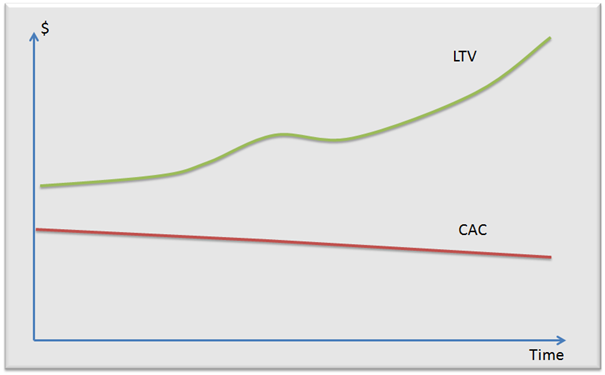

Drill down on Micro-Economics (Per Customer Profitability)

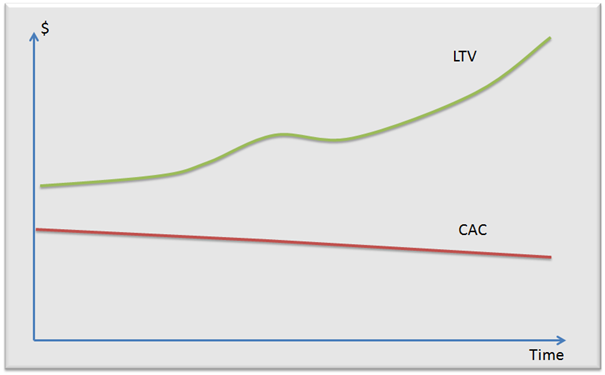

Our goal is to see a graph that looks like the following:

To achieve this, lets look at the component parts of each line, to see what variables we can use to drive the curves:

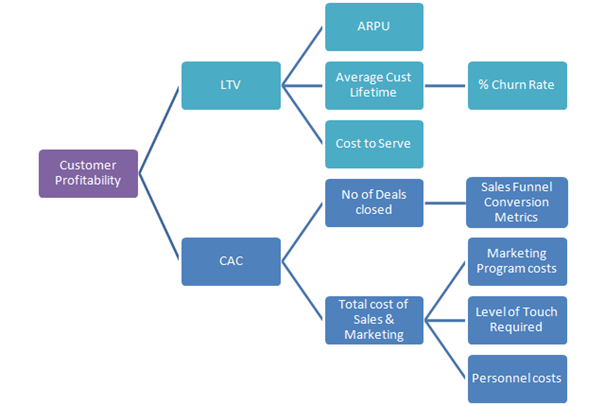

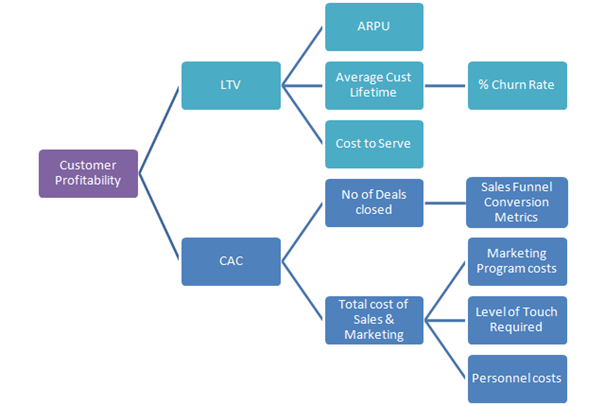

As mentioned earlier, customer profitability = LTV – CAC.

Drill down on LTV

Drilling down into the factors affecting LTV, we see the following:

LTV = ARPU x Average Lifetime of a Customer – the Cost to Serve them (COGS)

It turns out that the Average Lifetime of a Customer is computed by

1/Churn Rate. As an example, if a you have a 50% churn rate, your

average customer lifetime will be 1 divided by 50%, or 2 months. In

most companies that I work with, they ignore tracking the average

lifetime, but instead track the monthly churn rate religiously.

The importance of a low churn rate cannot be overstated. If your

churn rate is high, then it is a clear indication of a problem with

customer satisfaction. We will drill down later into how you can

measure the factors contributing to Churn Rate, and talk about how you

can improve them.

Drill down on CAC

The formula to compute CAC is:

CAC = Total cost of Sales & Marketing / No of Deals closed

It turns out that we are actually interested in two CAC numbers. One

that looks purely at marketing program costs, and one that also takes

into consideration the people and other expenses associated with

running the sales and marketing organization. The first of these gives

us an idea of how well we could do if we have a low touch, or touchless

sales model, where the human costs won’t rise dramatically over time as

we grow the lead flow. The second number is more important for sales

models that require more human touch to close the deal. In those

situations the human costs will contribute greatly to CAC, and need to

be taken into consideration to understand the true micro-economics.

I am often asked when it is possible to start measuring this and get

a realistic number. Clearly there is no point in measuring this in the

very early days of a startup, when you are still trying to refine

product/market fit. However as you get to the point of having a

repeatable sales model, this number becomes important, as that is the

time when you will usually want to hit the accelerator pedal. It would

be wrong to hit the accelerator pedal on a business that has

unprofitable micro-economics. (When you are computing the costs for a

very young company, it would be fair to remove the costs for people

like the VP of Sales and VP of Marketing, as you will not hire more of

these as you scale the company.)

When we look at how to lower CAC, there are a number of important variables that can be tweaked:

- Sales Funnel Conversion rates: a funnel that takes

the same number of leads and converts them at twice the rate, will not

only result in 2x more closed customers, but will also lower CAC by

half. This is a very important place to focus energy, and a large part

of this web site is dedicated to talking about how to do that. We will

drill down into the Sales Funnel conversion rates next.

- Marketing Program Costs: driving leads into the

top of your sales funnel will usually involve a number of marketing

programs. These could vary from pay per click advertising, to email

campaigns, radio ads, tradeshows, etc. We will drill down into how to

measure and control these costs later.

- Level of Touch Required: a key factor that affects

CAC is the amount of human sales touch required to convert a lead into

a sale. Businesses that have a touchless conversion have spectacular

economics: you can scale the number of leads being poured into the top

of the funnel, and not worry about growing a sales organization, and

the associated costs. Sadly most SaaS companies that I work with don’t

have a touchless conversion. However it is a valuable goal to consider.

What can you do to simplify both your product and your sales process to

lower the amount of touch involved? This topic is covered at the bottom

of a prior blog post: Startup Killer: the cost of acquiring customers.

- Personnel costs: this is directly related to the

level of touch required. To see if you are improving both of these, you

may find it useful to measure your Personnel costs as a % of CAC over

time.

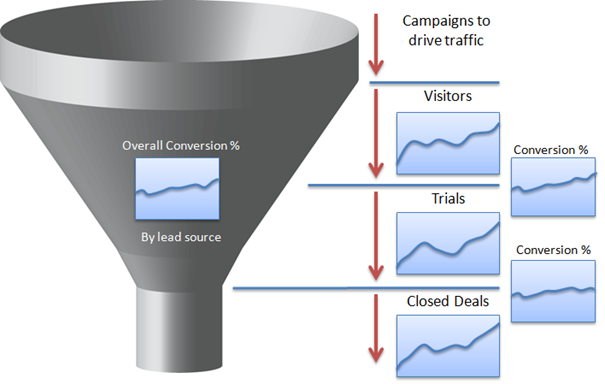

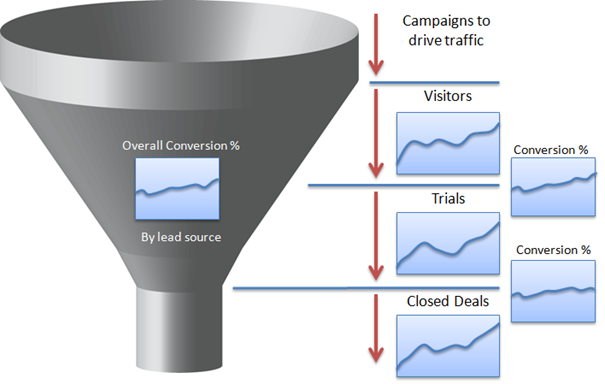

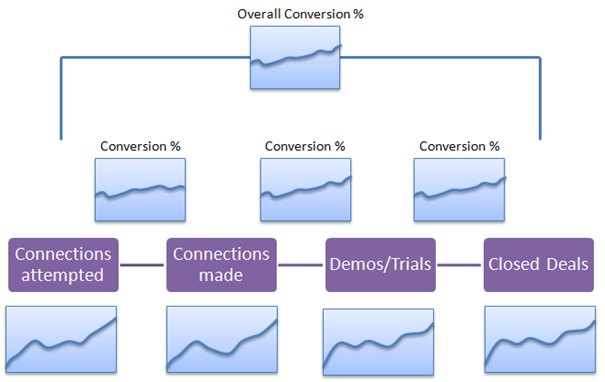

Drill down on Sales Funnel Conversion Rates

The metrics that matter for each sales funnel, vary from one company

to the next depending on the steps involved in the funnel. However

there is a common way to measure each step, and the overall funnel,

regardless of your sales process. That involves measuring two things

for each step: the number of leads that went into the top of that

step, and the conversion rate to the next step in the funnel (see

below).

You will also want to measure the overall funnel effectiveness by

measuring the number of leads that go into the top of the funnel, and

the conversion rate for the entire funnel process to signed customers.

The funnel diagram above shows a very simple process for a SaaS

company with a touchless conversion. If you have a conversion process

involving a sales organization, you will want to add those steps to the

funnel process to get insights into the performance of your sales

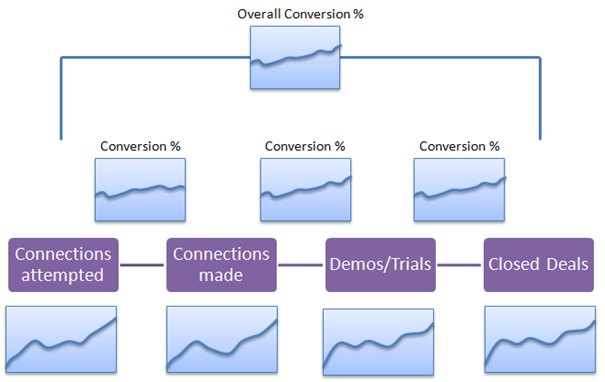

organization. For example, your inside sales process might look like

the following:

Here if we look at the closed deals and overall conversion rates by

sales rep, we will have a good idea of who our best reps are. For lower

performing reps, it is useful to look at the intermediate conversion

rates, as someone that is doing a poor job of, say, converting demos to

closed deals could be an indication that they need demo training from

people that have high conversion rates for demos. (Or, as Mark Roberge,

VP of Sales at HubSpot, pointed out, it could also mean that they did a

poor job of qualifying people that they put into the Demo stage.)

These metrics give you the insight you need into your sales and

marketing machine, and those insights give you a roadmap for what

actions you need to take to improve conversion rates.

Using Funnel Metrics in forward planning

Another key value of having these conversion rates is the ability to

understand the implications of future forecasts. For example, lets say

your company wants to do $4m in the next quarter. You can work

backwards to figure out how many demos/trials that means, and given the

sales productivity numbers – how many salespeople are required, and

going back a stage earlier, how many leads are going to be required.

These are crucial planning numbers that can change staffing levels,

marketing program spend levels, etc.

Drill down by Customer Type

If you have different customer types, you will want to look at all

the CAC and LTV metrics for each different customer type, to understand

the profitability by customer type. Often times this can lead you to a

decision to focus more energy on the most profitable customer type.

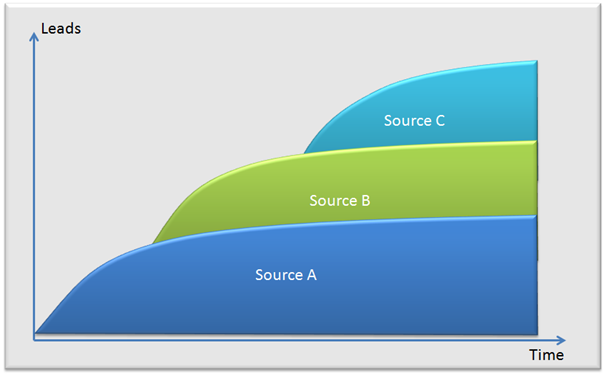

Drill down into ROI per Marketing Program

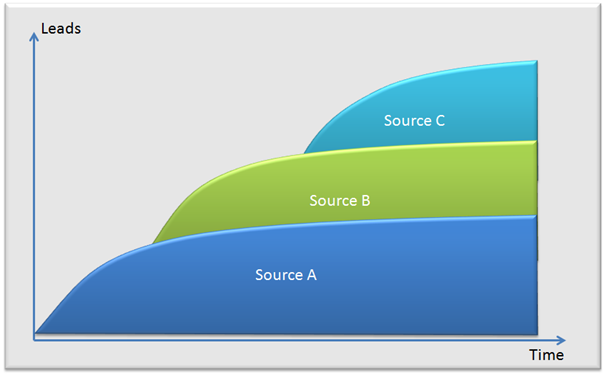

My experiences with SaaS startups indicate that they usually start

with a couple of lead generation programs such as Pay Per Click Google

Ad-words, radio ads, etc. What I have found is that each of these lead

sources tends to saturate over time, and produce less leads for more

dollars invested. As a result, SaaS companies will need to be

constantly evaluating new lead sources that they can layer in on top of

the old to keep growing.

Since the conversion rates and costs per lead vary quite

considerably, it is important to also measure the overall ROI by lead

source:

Growing leads fast enough to feed the front end of the funnel is one

of the perennial challenges for any SaaS company, and is likely to be

one of the greatest limiting factors to growth. If you are facing that

situation, the most powerful advice I can give you is to start

investing in Inbound Marketing techniques (see Get Found using Inbound Marketing).

This will take time to ramp up, but if you can do it well, will lead to

far lower lead costs, and greater scaling than other paid techniques.

Additionally the typical SaaS buyer is clearly web-savvy, and therefore

very likely to embrace inbound marketing content and touchless selling

techniques.

From Alistair Mitchell, CEO of Huddle: “Just calculating CAC can be

extremely complicated, given the numerous ways in which people find out

about your service. To stop getting too bogged down in the detail, its

best to start with a blended rate that just takes your total spend on

marketing (people, pr, acquisition etc) and split this across all your

customers, regardless of type or source. Then, once you’ve got

comfortable with that, you can start to break CAC down by the different

customer types and elements of your inbound funnel, and start measuring

specific campaigns for their contribution to each customer type.”

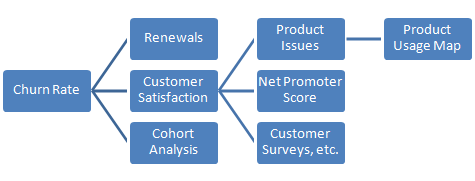

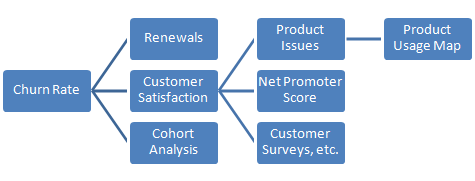

Drill down into Churn Rate

As described in the section on LTV, Churn Rate has a direct effect

on LTV. If you can halve your churn rate, it will double your LTV. It

is an enormously important variable in a SaaS business. Churn can

usually be attributed to low customer satisfaction. We can measure

customer satisfaction using customer surveys, and in particular, the Net Promoter Score.

If you are using longer term contracts, another key metric to focus

on is renewals. From John Clancy, ex-President of Iron Mountain

Digital: “

Non-renewals add to churn, but they can have different drivers. We

spent a lot of time examining our renewal rates and found that a single

digit improvement made a huge difference. Often times the driver on a

non-renewal is economic – the internal IT department has mounted a

campaign to bring the solution back in house. SaaS businesses need to

identify renewal dates and treat the renewal as a sales cycle (it’s

much easier and less expensive than a new sale, but it deserves the

same level of attention) Many SaaS businesses make the mistake of

taking renewals for granted.”

A good predictor of when a customer is about to churn is their

product usage pattern. Low levels of usage indicate a lack of

commitment to the product. It can be a good idea to instrument the

product to measure this, looking for particular features our usage

patterns that are correlated with stickiness, or a likelihood to churn.

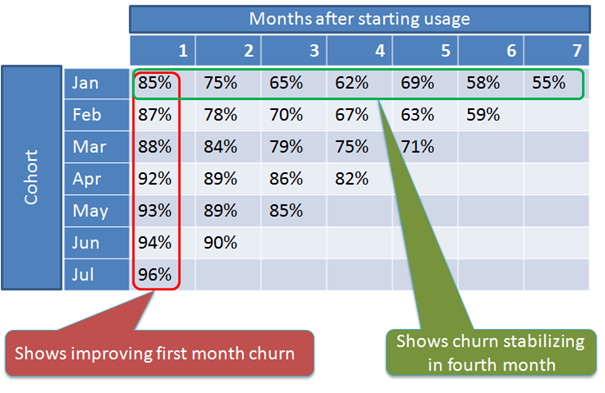

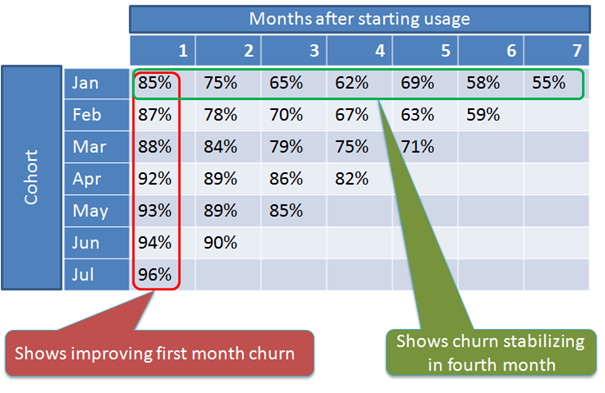

Another measurement tool that can be very useful in understanding

churn is to look at a Cohort Analysis. The term cohort refers to a

group of customers that started in the same month. The reason for doing

this is that churn varies over time, and using a single churn number

for all customers will mask this. Cohort analysis shows:

- How churn varies over time (the green call out below).

- How churn rates are changing with newer cohorts, (the red call out

below) For example in the early days of your SaaS company, you may

have serious product problems and lose a lot of customers in the first

month. Over time your product gets better, and the first month churn

rate will drop.

Cohort analysis will show this, instead of mixing all the churn rates into single number.

Here’s a comment on Cohort Analysis from Alastair Mitchell, CEO of

Huddle: “I actually think this is more important than churn, for the

simple fact that churn varies over the lifetime of a customer cohort,

and just looking at monthly churn can be very misleading. Also, given

the importance of payback in a year – you really want to look at churn

over the course of a 12 months cohort. For instance, in the first 3

months of a monthly paying customer you will see high churn (3 is a

recurring ‘magic’ number in all of retail), then reduced churn

(sometimes even positive churn) over the next 3 months less and then

probably more stable spend over the next 6 months. The number you

really care about is the % of customers spending after 12 months (not

necessarily on a monthly basis) as that’s what matters for your CAC

payback calculations.”

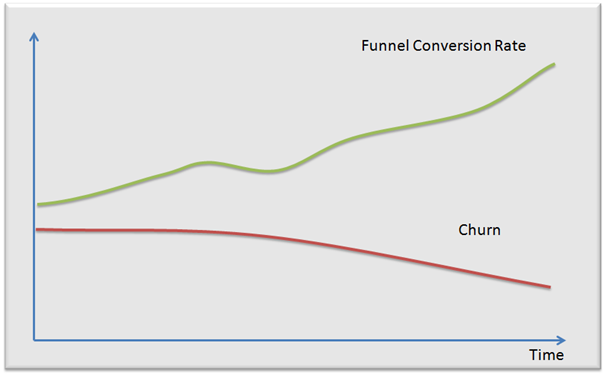

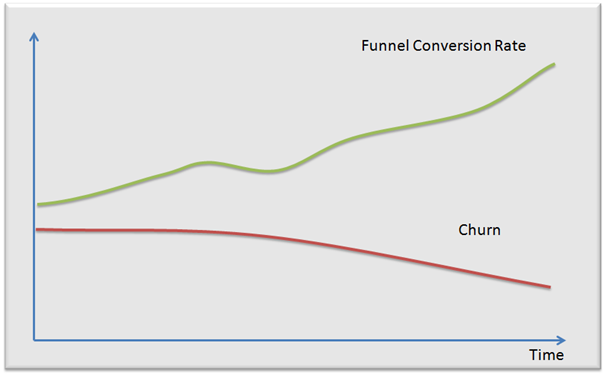

Two variables that really matter

As we saw above, there are two variables that have a huge effect on

a SaaS business: funnel conversion rate, and churn, and it is not a bad

idea to graph them as shown below.

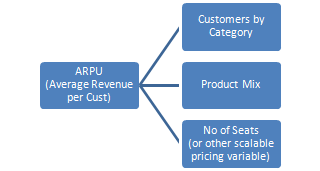

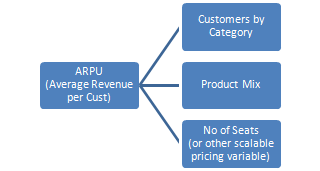

Drill down into ARPU (Average Revenue per Customer)

ARPU is often different for different customer categories, and

should be measured separately for each category. It can usually be

driven up by focusing on:

- Product Mix: adding products to the range, and using bundles, and cross-sell and up-sell

- Scalable Pricing: there are always some customers

that are willing to pay more for your product than others. The trick is

developing a multi-dimensional pricing matrix that allows you to scale

pricing for larger customers that derive more value from the product.

This could be pricing by the seat used (Salesforce.com), or by some

other metric such as number of individuals mailed in email campaigns

(Eloqua).

If you are using scalable pricing, it will be valuable

to measure what the distribution is of customers along the various

axes. You could imagine taking an action to do after more seats inside

of existing customers as a way to drive more revenue. etc.

Drill down into Cash

We already discussed Months to recover CAC as a key variable. There

is another way to affect Cash: which is using longer term contracts and

incenting your customers to pay for 6, 12, 24, or even 36 months up

front in advance. This can mean the difference between needing to raise

tons of venture capital and giving away ownership, or being able to

grow the business in a self-funded manner. Given the cost of capital,

you can often calculate what discount makes sense. (If capital is cheap

and freely available, it doesn’t make sense to give much discount.)

If you do use longer term contracts, it will be important to measure “Discretionary Churn”.

Since some of your customers are locked in and cannot churn, they could

artificially lower your overall churn numbers. The way to understand

what is really going on is to look at the discretionary churn, which is

the churn rate for all customers that are at the point where they have

the option to churn, removing those whose contracts would have

prevented them from churning.

Cash Management and forecasting

Cash is one of the most important items to get right in any startup.

Run out of cash, and your business will come grinding to a halt

regardless of how good any of your other metrics may be. One of the

most important ways to run a SaaS company is to look at CashFlow

profitability (not recognized revenue profitability). What is the

difference: If your business only gets paid month by month, there will

be no difference, but if you get longer term contracts, and get paid in

advance, you will receive more cash upfront than you can recognize as

revenue, so your cash flow profitability will look better than your

revenue profitability, and is a more realistic view of whether you can

survive day to day on the money coming in the door.

Here is another comment from Alastair Mitchell of Huddle on this

topic: “SaaS companies tuning their model should think not just in

terms of the months to recover CAC, but also the topline amount of cash

required to get to cashflow profitability (or the next funding round).

This is probably the single biggest mistake I see in early stage

companies. They don’t look ahead, using these metrics, to figure out

that if the time to repay CAC is 12 months, then in aggregate they are

going to need 12 months of CAC spend PLUS the number of months required

of further growth to cover their operating costs (mostly engineering)

BEFORE they are even cashflow positive (let alone revenue

profitability). Most businesses I see fundamentally miss this and end

up short; frequently through under-estimating the time to recover CAC,

and churn. The readers of this blog should be focused on cashflow

profitability, not revenue profitability. (Hence why your point about

annual/upfront contracts is so important)”

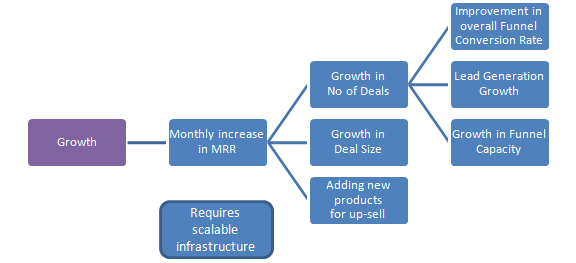

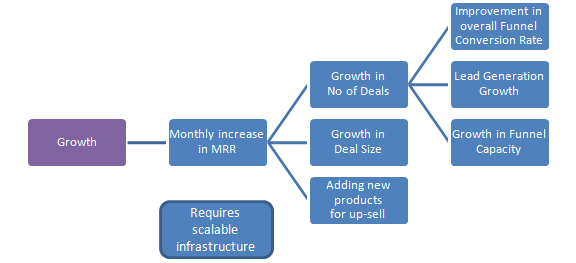

Drill down into Growth

Focusing on Growth as a separate parameter can be highly valuable.

It is the nature of a SaaS business to grow MRR month on month, even if

you only added the same number of customers every month. However your

goal should be to grow the number of new customers that you sign up

every month. You can do this by focusing on:

- Improvement in the overall funnel conversion rate

- Lead Generation Growth

- Growth in Funnel Capacity

The first two have been covered already. The last bullet: Growth in

Funnel Capacity is an often overlooked metric that can bite you

unexpectedly if you don’t pay attention to it. In my second startup, I

had a situation where sales growth stalled after growing extremely

rapidly for a couple of years. The problem, as it turned out, was that

we had stopped hiring new sales people after reaching 20 people, a

number that felt very large to me, and had maxed out on sales capacity.

We started sales hiring again, and a couple of years later the business

hit a $100m run rate. I witnessed a similar phenomenon at Solidworks,

when after 2-3 years of phenomenal growth, their growth slowed. It

turned out that their channel sales capacity had stopped growing.

Solidworks started measuring and managing something that would later

turn out to be a critical metric: channel capacity in terms of the

number of FTE (Full Time Equivalent) sales people in their channel, and

the average productivity per FTE. This has helped propel them to over

$400m in annual revenues.

Another great way to grow your business is by adding new products

that can be up-sold, or product features that can lead to a higher

price point. Since you already have a billable contract, it is

extremely easy to increase the amount being charged, and this can often

be done with a touchless sale.

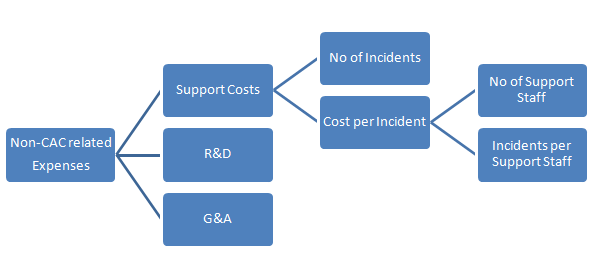

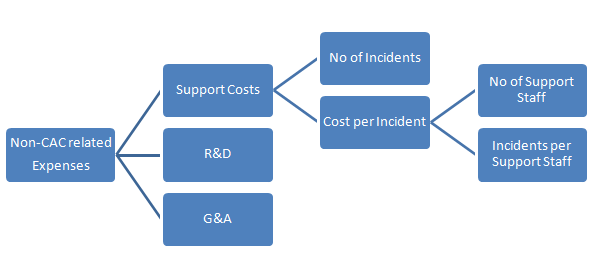

Other Metrics

There are a series of less important metrics that can still be

useful to be aware of. I have listed some of these in the diagrams

below:

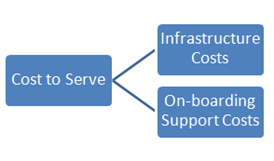

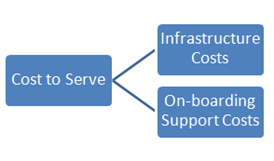

After posting the above, I received a note from Gail Goodman of

Constant Contact, noting that they include the cost of on-boarding a

customer in CAC, not LTV as I have shown. Given that they are a public

company with significant accounting scrutiny, this is likely the right

way to do things.

Conclusions

If you have kept reading this long, it likely means that you are

likely an executive in a SaaS company, and truly have a reason to care

about this depth of analysis. I would very much like to hear from you

in the comments section below to see if I have missed out on metrics

that you think are important.

The main conclusion to draw from this article, is that a SaaS

business can be optimized in many ways. This article aims to help you

understand what the levers are, and how they can affect the key goals

of Profitability, Cash, Growth, and market share. To pull those levers

requires that you first measure the variables, and watch them as they

change over time.

It also requires that you implement a very metrics driven culture,

which can only be done from the top. The CEO needs to use these metrics

in her staff meetings, and those execs need to use them with their

staff, etc. Human nature is such that if you show someone a metric,

they will automatically work to try to improve it. That kind of a

culture will lead to true operational excellence, and hopefully great

success.

David Skok is a General Partner with Matrix Partners in Waltham, Massachusetts. This blog post was originally published on February 17, 2010. You can find this post, as well as additional content on his blog called For Entrepreneurs.